- The Federal Reserve is set to remain dovish at its July meeting this week to the benefit of risk assets.

- The Fed is likely to keep its view that recent surges in inflation caused by the US economy reopening may only be transitory and thus not require monetary policy to be tightened yet.

- The central bank is also likely to stress it remains far from meeting its goal of maximum employment while the Delta variant may cause near-term headwinds to the recovery.

- Thus, we expect officials to signal that tapering quantitative easing still remains months away with a decision only likely in December that the Fed will slow its bond buying from January.

The Federal Reserve is set to remain dovish this week, continuing to buy USD120 billion a month of bonds, keeping its fed funds rate at 0.00-0.25% to support the recovery, and noting any tapering of quantitative easing still remains months away.

First, the Fed will keep its view that rises in inflation due to the US economy reopening may only be transitory. The first chart shows core inflation as given by personal consumption expenditure (PCE) prices is running well above the central bank’s 2% target. But almost all the increase is being driven by just a few items such as soaring car prices and surging airfares, hotels and other lodging costs that will ease as global semiconductor shortages abate and reopening demand for services settles down again.

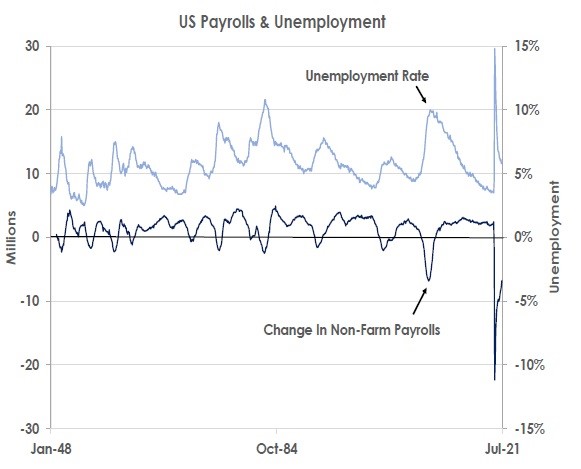

Second, the Fed will also stress that the economy remains far from maximum employment. The second chart shows the labour market is still almost 7 million jobs short of pre-pandemic levels.

Third, officials may highlight near-term risks from the Delta variant. The last chart shows the US and UK purchasing manager indices (PMI) fell in July.

We expect Chairman Powell will note the economy still needs to make ‘substantial further progress’ before the Fed will taper its quantitative easing. We think officials will discuss the timing this week and in September but only announce in December that the Fed’s bond buying will start being cut from January. We thus see the dovish Fed continuing to support risk assets in 2021.

This article was first published by Bank of Singapore on July 26, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.