The US economy has started the year strongly underscoring the favourable outlook for equity markets before President Trump’s surprise threat on February 1 to impose new tariffs on Canada, Mexico and China.

Source: Bloomberg, Bank of Singapore

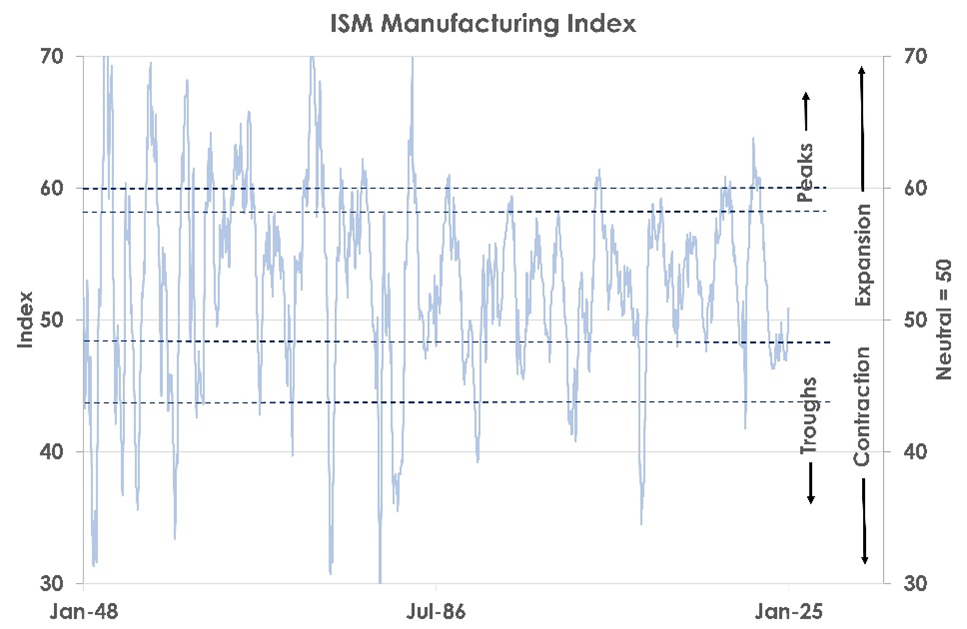

Firstly, January’s manufacturing ISM survey signalled activity is expanding for the first time in over two years. As the chart shows, last month’s reading of 50.9 was the first over 50.0 since October 2022.

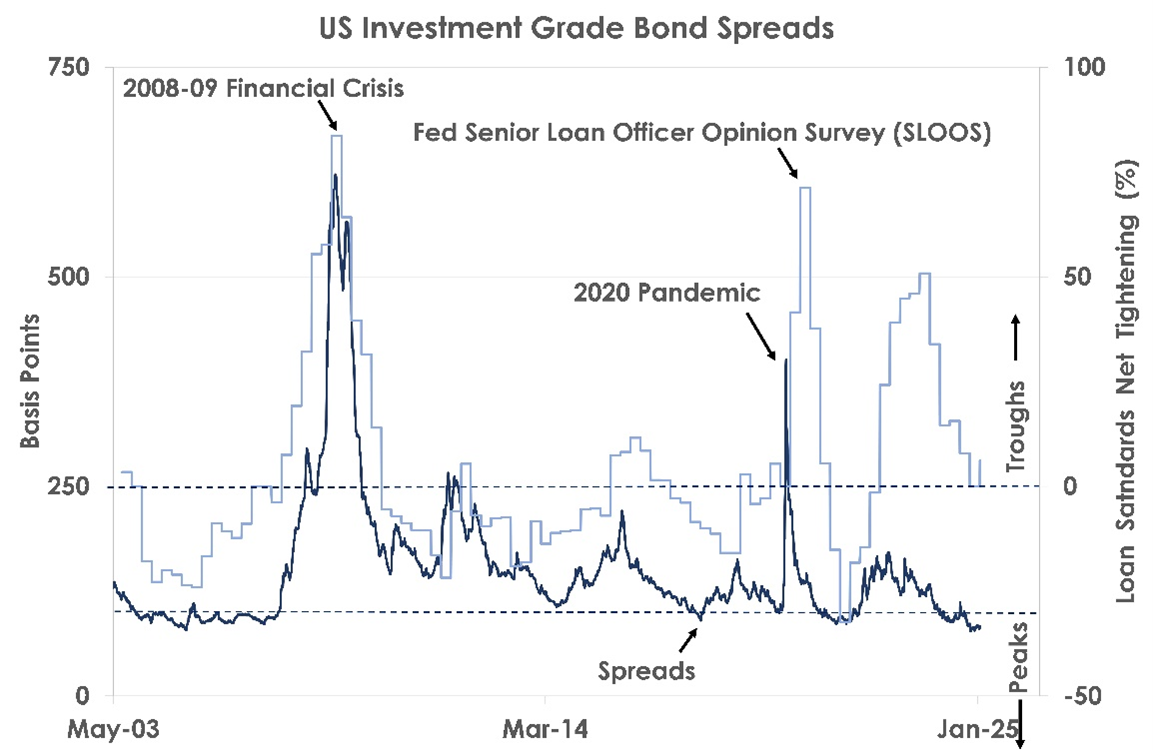

Secondly, the latest Federal Reserve Senior Loan Officer Survey (SLOOS) showed only a net 6% of banks were tightening standards for loans in Q4’24. As the next chart shows, conditions for bank lending are still loose keeping corporate bond spreads tight.

Source: Bloomberg, Bank of Singapore

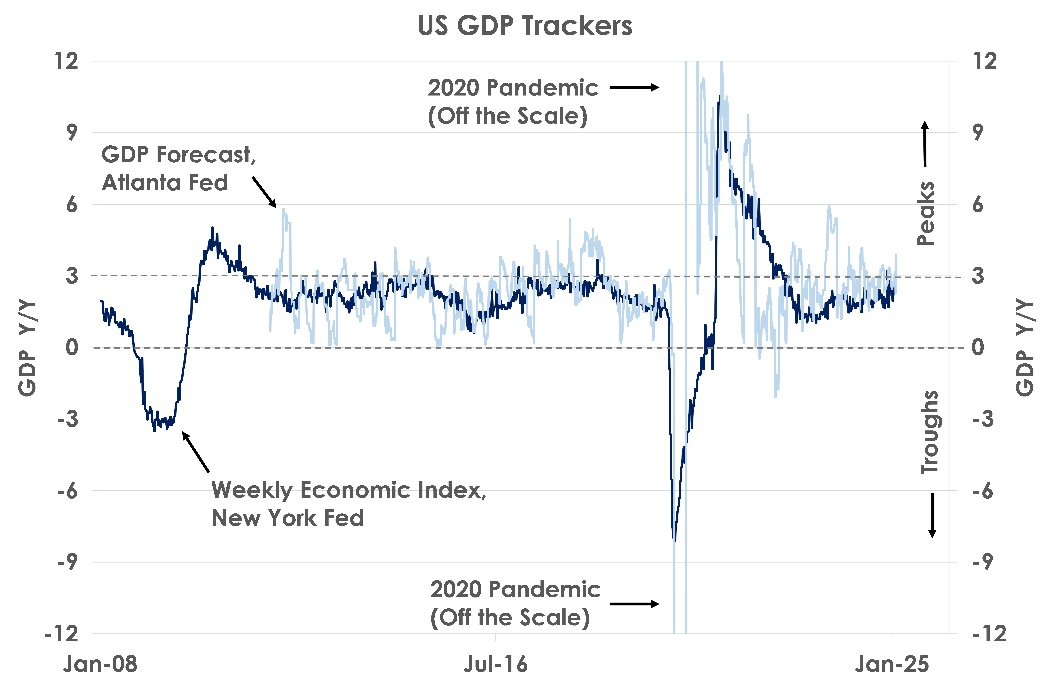

Thirdly, high-frequency trackers of US GDP from Fed institutions estimate growth currently may be as high as 3-4% - after GDP already expanded by a strong 2.8% in 2024.

Source: Bloomberg, Bank of Singapore

The chart shows the New York Fed Weekly Economic Index, implies GDP is expanding near 3.0% while the Atlanta Fed’s forecast is 3.8%, both far higher than the 2.3% average annual US growth rate since 2000.

Though Trump delayed US tariffs by one month on Canada and Mexico, further 10% tariffs on Chinese exports took effect today. We see firm US growth supporting US equities. But trade wars and inflation risks will elevate US Treasury yields. We think US 10Y yields will hit 5.00%, keeping us cautious on duration.

This article was first published by Bank of Singapore on 4 February, 2025. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of OCBC Private Bank or its affiliates.

OCBC Private Bank provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC Private Bank is a part of OCBC Group.