Travel Miles for your every traveling needs

With activation and monthly transaction accumulation

Access to over 1,300 International Airport Lounges in over 137 countries with DragonPass

Cash Out Remaining Limit

Now you can withdraw the remaining credit card limit directly into your savings account with interest up to 0% via OCBC mobile.

Info: web.ocbc.id/cairlimitcc

Taking the MRT abroad just TAP

With the Contactless feature, valid in countries and transportation companies that accept payments by Credit Card and contactless

Contactless Feature

Equipped with contactless features for convenience, security & faster transaction

Travel Miles

Travel miles for every your retail transaction

Faster Miles Collecting

Earn travel miles faster for certain transactions abroad

Bill Payment Facility

Paying various monthly bills easily and more practically

Accepted Worldwide

Shopping at more than 29 million merchants and International VISA partners

Access Cash Worldwide

Easiness cash withdrawals at more than 1 million ATMs worldwide anytime

Pay Flexible Bills

Payment credit card bills minimum 5% of the total bill

Payment Methods Vary

Pay credit cards easily anytime and anywhere

Easy transaction via Alipay/Weixin Pay with OCBC Credit Card

Now traveling abroad is easier because you can transact on Alipay & Weixin Pay with OCBC Credit Card. Info: web.ocbc.id/trxchina

Get 1 Travel Miles just by making a transaction using 90°N Credit Card for IDR2,116 = 1 GarudaMiles or IDR2,222 = 1 KrisFlyer

1 Travel Miles can be exchanged for 1.05 GarudaMiles or 1 KrisFlyer/AirAsia points

*Valid for new 90°N Credit Card customers with a minimum overseas transaction of Rp40 million at hotel, restaurant and transportation merchants within 3 months after the card is approved.

Shopping transactions that earn Travel Miles are retail shopping transactions from the main Credit Card and additional Credit Cards that have been recorded in the Bank's system and do not include all installment transactions, cash withdrawals, Loan on Phone and canceled transactions.

| Type of Retail Transaction | Nominal Transaction | Get Travel Miles* |

|---|---|---|

| Domestic Transaction | IDR10,000 | 1 Travel Miles |

| Overseas Transactions (Non IDR) | IDR 8,000 | 1 Travel Miles |

| Overseas Transactions specifically for the Restaurant, Hotel & Flight Transportation categories** | IDR 4,000 | 1 Travel Miles |

**Maximum 500 Travel Miles/month (maximum transaction IDR2,000,000/month)

| Miles Simulation | GarudaMiles* | KrisFlyer |

|---|---|---|

| Total Transaction | IDR40 Million | IDR40 Million |

| Travel Miles (Every IDR8,000 transaction = 1 Travel Miles and IDR7,619 = 1 GarudaMiles) | 5.250 | 5.000 |

| Welcome Bonus | 13.650 | 13.000 |

| Total Travel Miles | 18.900 | 18.000 |

| Earning Rate | 2.116 | 2.222 |

*Minimum transaction to get Travel Miles abroad is IDR8,000

Transaction calculation is Total transactions abroad ÷ total points earned by the Customer

| Travel Miles EarningTM | |

|---|---|

| Every Domestic Transactions IDR10,000 = 1 Travel Miles | 4.000 |

| Bonus Travel Miles | 13.000 |

| Total Travel Miles | 17.000 |

Contactless Feature

Easier payments with contactless features and accepted Worldwide. OCBC 90°N Credit Card is equipped with contactless features for convenience, security and faster transaction.

Accepted Worldwide

OCBC NISP 90°N is accepted worldwide with more than 29 million merchants and service partners that collaborate with VISA international.

Worldwide Access to your Fund

Apart from being able to do fund withdrawal in all OCBC Branches, OCBC 90°N Credit Card can also be used for fund withdrawal in more than 1 Million ATMs worldwide, 24 hours a day and 7 days a week. You can withdraw up to 60% of your OCBC 90°N Credit Card limit by visiting the nearest ATM and selecting the cash withdrawal menu using your Credit Card PIN.

Bill Payment Facility

Your OCBC Credit Card can be used to pay recurring utilities payment such as TELKOM, PLN, PAM, TV Subscription, IPL (building maintenance fee) and Insurance by:

Bill payment flexibility

Your OCBC credit card payment can be done by paying the minimum 5% of the total bill or IDR 50,000 (whichever is higher).

You can pay your OCBC 90°N bill by various methods:

Tanya OCBC (Contact Centre)

We are ready to serve you 24 hours a day 7 days a week to get information about OCBC 90°N credit card with contact Tanya OCBC1500-999/+62-21-26506300 (from overseas) or e-mail tanya@ocbc.id

Complimentary access at the International Airport Lounge and Domestic Airport Lounge in collaboration with OCBC through the DragonPass Application. Main Credit Card Owner and an supplementary Credit Card OCBC 90⁰N owner are entitled to enjoy two complimentary visits per year to the Airport Lounge.

To obtain the Membership Number and Activation Code DragonPass, please contact TANYA OCBC 1500-999 at least 3 days before to the departure date. Make sure the DragonPass membership app is downloaded and registered. Click here for more details.

List of cooperated Domestic Airport Lounges via DragonPass Application:

| No | Kota | Nama Airport | Nama Airport Lounge* | Terminal |

|---|---|---|---|---|

| 1 | Bandung | Husein Sastranegara International Airport | Saphire Blue Sky Lounge | Main Terminal |

| 2 | Bangka Island | Depati Amir Airport | Saphire Blue Sky Lounge | Domestic Terminal |

| 3 | Jakarta | Halim Perdanakusuma International Airport | Saphire PremiAir Executive Lounge | Departure Terminal |

| Soekarno-Hatta International Airport | Saphire Blue Sky Lounge (Domestic T3 - Gate 13) | Terminal 3 | ||

| Saphire Blue Sky Lounge (T3 Domestic - Gate No.18) | ||||

| Plaza Premium Lounge (Gate7) | ||||

| Saphire Lounge | Terminal 2F | |||

| 4 | Jambi | Sultan Thaha Airport | Saphire Lounge | Domestic Terminal |

| 5 | Medan | Kualanamu International Airport | Saphire Mandai Excecutive Lounge (International) | International Terminal |

| Saphire Blue Sky Premier Lounge | Terminal 1 |

Note : *) Airport Lounge Operational Day and hours are entirely under respective Airport Lounge’s authority, not the authority of the Bank

Definitions

In these Terms and Conditions, unless expressed otherwise in the context, the following terms shall have the following meaning:

"Automated Teller Machine" hereinafter referred to as "ATM" means a machine which can be used by the Cardholder to access banking services for 24 hours

"Bank" means PT Bank OCBC NISP Tbk, a banking company registered and supervised by the Financial Services Authority, domiciled in South Jakarta and having its address at OCBC Tower, Jalan Prof. Dr. Satrio Kav. 25 Jakarta 12940 including all of the bank's branch offices in Indonesia.

"Cash Advance Limit" means the maximum limit for cash advance made at the Counter or ATM pursuant to the limit approved by the Bank, where such cash advance shall be subject to Administration Fee and Interest, calculated on a percentage basis of total cash advance or a certain minimum amount determined by the Bank.

"Stamp Duty" means the tax levied on documents under the provision of the applicable laws charged to the Cardholder for every payment made.

"Administration Fee" means fees charged by the Bank to the Cardholder with regards to the use of Credit Card.

"Late Charge" means fees charged to the Cardholder when he/she pays the bill after the Due Date

"Billing Statement" means a notification to the Primary Cardholder which, among others, inform about Current Month's Total Bill, total Minimum Payment and the Due Date for making payment within a particular Credit Card billing period.

"Interest" means the interest expense charged to the Cardholder if Current Month"s Billing Statement is not paid in full and/or if the payment is made after the Due Date

"Tanya OCBC" means PT Bank OCBC NISP, Tbk banking call service which can be contacted at 1500-999 or other numbers informed by the Bank from time to time.

Interest and Fees

| Annual fee (free of the first year fee) | Primary Card IDR 1,000,000 per year, Supplementary Card: IDR 500,000 per year |

| Retail Interest | 1.75% per month, 21% per year |

| Cash Advance Interest | 1.75% per month, 21% per year |

| Minimum Payment | 5% of the bill or a minimum of IDR 50,000 (Until 30 June 2025 or always binding with Bank Indonesia regulations) |

| Cash Advance Fee | 6% or a minimum of IDR 100,000 (whichever is greater) |

| Late Payment Fee (Late Charge) | 1% of the total bill, minimum IDR 50,000 and maximum IDR 100,000 (Until 30 June 2025 or always binding with Bank Indonesia regulations) |

| Over-limit Fee | 6% of the excess limit, a minimum of IDR 100,000 and a maximum of IDR 250,000 |

| Lost/Damage Card Replacement Fee | IDR 100,000 |

| Billing Statement Delivery Charge | IDR 12,500 per billing |

| Transaction Copy Request Fee | Transaction Note IDR 50,000 , Monthly Bill IDR 30,000, and Declined Check / Giro Fee IDR 25,000 |

| Duty Stamp Charged for Payments with Certain Amount | Payment amounted above IDR 5,000,000 will be charge Duty Stamp IDR 10,000 |

| Credit Card Payment Costs through Teller at OCBC Branch | IDR 10,000 |

| Installment Request Fee |

Through ONe Mobile Application or other channels IDR 15,000 per transaction Through Contact Center – Tanya OCBC IDR 20,000 per transaction |

| Installment Payment Cancellation/Acceleration Fee | IDR 200,000 per transaction |

| Transfer fee | - IDR 10,000 to OCBC account - IDR 25,000 to another bank account |

|

E-Statement via Email Fee Request Increase Limit Fee Notification Charges |

IDR 5,000 per bill per month IDR 50,000 per request IDR10,000 per bill per month |

| Important Information |

|

Interest Calculation for Shopping Transactions (Retail):

Interest will be charged if the Cardholder pays less than the total of the new bills, or pays after the Due Date. Interest on Purchase Transactions is calculated based on the Posting Date of the transaction made. The interest rates that apply to purchase transactions are listed on the billing statement. Unpaid fees, penalties, or interest are not included into the interest calculation component. Interest will be charged on the next billing statement. For a complete interest calculation can be seen in the credit card interest calculations illustration.

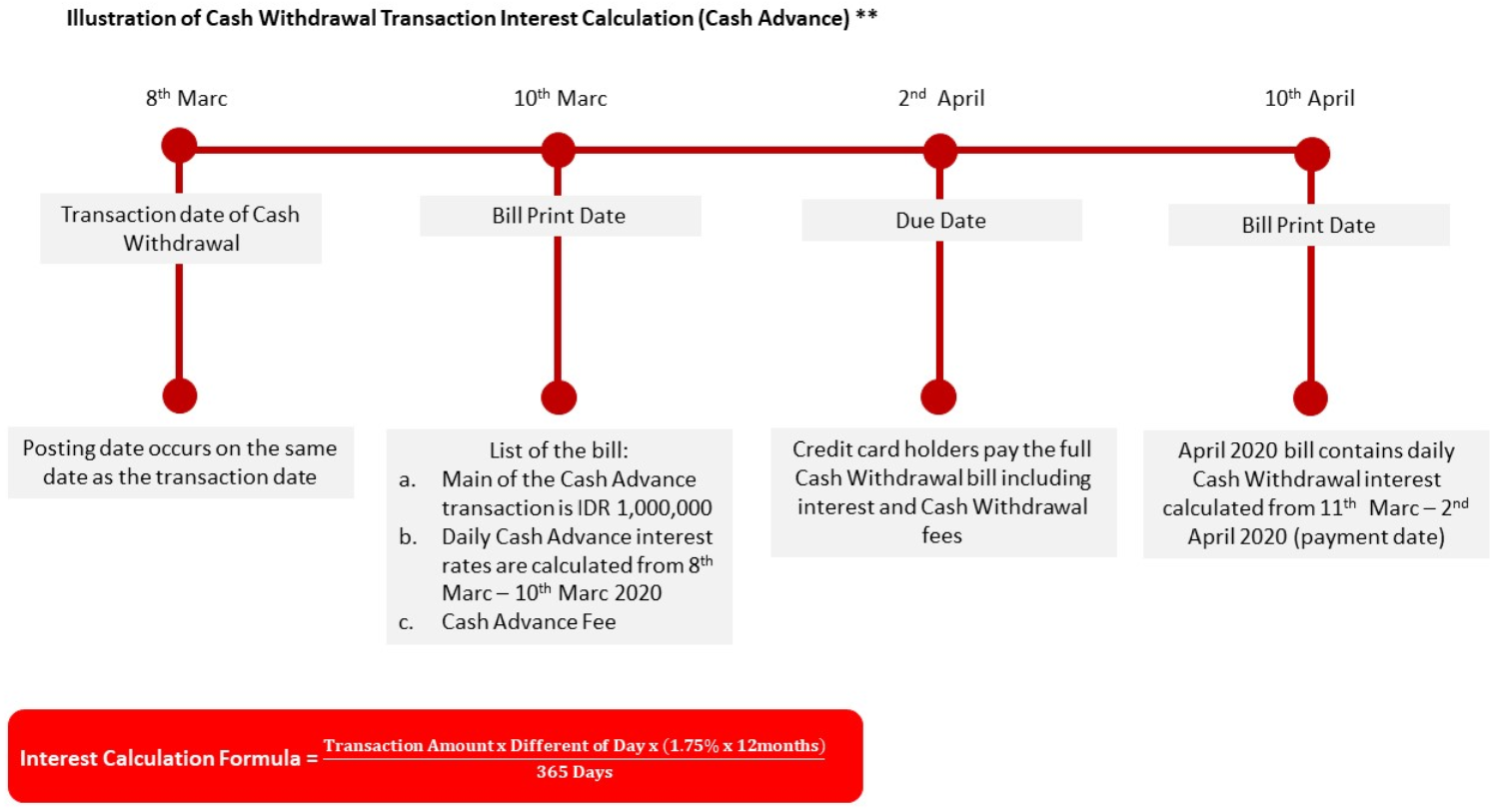

Interest Calculation for Cash Advance Transactions:

Interest for Cash Advance is charged and calculated from the Cash Advance Date until the full payment date of the Cash Advance transaction. The interest rates that apply to Cash Advance transactions are listed on the Billing Sheet. Unpaid fees, penalties, or interest are not included in the interest calculation component. For a complete interest calculation can be seen in the illustration of the Credit Card Interest Calculation.

* This illustration uses the Platinum Credit Card due date

Note:

Illustration of interest calculation can give different results caused by:

The example of calculation of interest on Cash Advance transactions:

The Cash Advance transaction of IDR 1,000,000 is made and recorded on March 8, 2020. The Billing Statement print date is March 10, 2020. The Due Date is April 2, 2020.

The Cash Advance transaction interest that printed on the Billing Statement sheet for April 2020 is IDR 1,726 (*** see calculation method below).

Image of interest day calculation for Cash Advance transactions

** This illustration uses the calculation of the Titanium Credit Card due date

*** The interest calculation for the Cash Advance transaction was billed in April 2020 as follows:

Interest = IDR 1,000,000 x 3 x (1,75% x 12 months) / 365 = IDR 1,726

All Credit Card transaction in Indonesia required to using PIN.

Get your 6 digit OCBC Credit Card PIN by following:

SMS Format:

OCBC[space]SETPINCC[space]Last 4 Digit Credit Card#Date of Birth DDMMYYYY#Your 6 Digit PIN

For Example: OCBC SETPINCC 1234#14121990#180825

(*Create PIN through OCBC mobile only for Basic Card Holder)

(**Create PIN through SMS for Basic and Supplement Card Holder using the registered telephone number on the Bank)

For further information, please contact Tanya OCBC 1500-999.

Information on The Billing Statement

The billing statement is a summary of transaction details of your OCBC Credit Card (from the previous month's billing date up until the subsequent billing date). Details of transactions printed are transactions made using the primary card and the supplementary card (if any). There is no separate billing statement for supplementary cards.

Primary Credit Card Number

This is OCBC Primary Credit Card number.

Statement Date

This is the date of transactions and other outstanding balances billing. It will fall on the same date each month.

Payment Due Date

This is the payment deadline for the outstanding balances on which the payment shall have been received by PT. Bank OCBC NISP, Tbk, namely 16 days for Platinum, 90°N, Voyage Credit Card and 23 days for Titanium Credit Card as from the billing date. A minimum payment must be paid off each month on or before the due date even if you have not received the Billing Statement. Payment received after the due date shall be subject to late charge.

Current Month's Bill

This is the outstanding balance on the billing date which includes previous month's outstanding balance and transactions made up to the billing date, fees, interests and corrections deducting payments and credit.

Minimum Payment

The minimum payment is 5% of the outstanding balance or IDR 50,000 (whichever higher)*. If your outstanding balance exceeds your credit limit, such excess shall be added to the minimum payment which is about to become due. If you have not paid off the previous month's minimum payment, such amount shall also be added to your minimum payment which is about to become due. If there is any instalment transaction, it shall be billed in full.

*Until 30 June 2025 or always binding with Bank Indonesia regulations

Transaction Date

This is the date of the transactions of purchase, cash advance or other transactions made using OCBC Credit Card.

Posting Date

This is the date on which your transaction is posted or charged to your OCBC Credit Card account.

Transaction Description

This column contains information on the details of transaction made using your OCBC Credit Card:

Purchase

This is the total amount of purchase transactions of your OCBC Credit Card in the current month.

Administration Interests & Fees

This is the amount of interest (only if there is an interest expense) and administration fees charged.

Payment

This is the amount of payment of the OCBC Credit Card bill which you have made.

Total

This is the total amount of bill you have to pay in the current month.

Combined Limit

Total credit limit assigned to a cardholder through 1 or more credit card(s) owned. The total credit limit of your OCBC Credit Card constitutes the combination of credit limit of all credit cards you own. If you only have 1 card, the combined limit is equal to your Primary Card limit.

Remaining Combined Credit

This is the remaining amount of credit limit up until the billing date and can be used for transactions.

Current Miles

Is the number of Miles you earned this month.

Miles Expired Next Month

Is information on the number of miles that will expire.

Expiry Date

Is the deadline date for your Miles to be valid.

Interest Rate (% of Retail Interest)

This is the information on the interest rate to be applied due to the customer's failure in making full payment of a bill. The rate is determined by the bank.

Interest Rate (% Cash Advance)

This is the information on the interest rate to be applied for cash advance transactions, the rate is determined by the Bank.

Note:

You will be charged the interest for:

Partner Merchants in Indonesia

Deal with special offers from Bank OCBC partner merchants in Indonesia

VISA Partner Merchants

Trade with special offers from VISA merchants all over the world

Partner Merchants in Singapore and Malaysia

Trade with special offers from VISA merchants in Singapore and Malaysia

90°N Credit Card, OCBC Nyala Platinum, Platinum Credit Card, Titanium Credit Card, Voyage Credit Card

12 Jun 2024 - 2 May 2026

Debit Card, GPN Debit Card, Online Debit Card, Premier Debit Card, 90°N Credit Card, Platinum Credit Card, Titanium Credit Card, Voyage Credit Card

1 Jun 2022 - 1 Apr 2026

| Terms | OCBC 90°N Credit Card |

|---|---|

| Age | Main Card Holders aged 21 - 65 years Additional Card Holders for a minimum of 17 years (Maximum 3 people |

| Citizenship | Indonesian citizen and foreign national |

| Income | Min Income: IDR 120,000,000 per year. |

| Personal Identification Documents | Photocopy of KTP or Photocopy of Passport / KIMS / KITAS (For foreigners only) or Photocopy of Other Bank Credit Cards (For Other Bank Customers) |

| Income Document | Original month's latest salary slip / Statement of Income (Especially Employees and Foreigners) or Photocopy of SIUP / Company Establishment Deed Current account / savings account for the last 3 months (only for entrepreneurs) or Current Account / Savings Account for the last 3 months, Photocopy of Practice Permit and Photocopy of SPT (Professional Only) or Photocopy NPWP. |

Redeem your Travel Miles through Raih.id which can be accessed via a browser or the OCBC mobile application.

Collect Miles from Favorite Airlines or Exchange Whatever Your Travel Needs with OCBC 90°N Credit Card

File an objection due to a transaction incompatibility, no later than 45 calendar days from the date the Billing Statement is sent. Please submit your objections to Call OCBC 1500-999 or + 62-21-26506300 (from abroad)

Main Card IDR 1,000,000 per year, Supplementary Card: IDR 500,000 per year (Free of first year tuition fees)

OCBC mobile Application *

Download the latest version of the OCBC mobile Application and follow these steps:

(* Create PIN via OCBC mobile only for Primary Card holders)

Credit Cardholders can simply contact OCBC Call 1500-999 or + 62-21-26506300 (from overseas) for the process of blocking a lost Credit Card and submit a credit card replacement at a cost of Rp 100,000 for OCBC Titanium, Platinum, and 90 Credit Cards ° N and costs IDR 2,500,000 for an OCBC Voyage Credit Card.

Travel Miles Bonus

*Enjoy an Activation Bonus of 13,000 (Thirteen Thousand) Travel Miles

** Enjoy 1,000 (one thousand) Travel Miles monthly Bonus

Collect Travel Miles Faster

| Travel Miles EarningTM | |

|---|---|

| Every Domestic Transactions IDR10,000 = 1 Travel Miles | 4.000 |

| Bonus Travel Miles | 13.000 |

| Total Travel Miles | 17.000 |

Did not find what you're looking for?

See FAQ