Shopping online directly with debits from 12 currencies, without conversion fee! Enjoy various promotions

With contactless feature, shopping & ride MRT in abroad just tap/dip card & direct debit from 12 currencies, without conversion

Free cash withdrawal throughout the OCBC ATM network in Singapore, Malaysia and Hong Kong. (T&C applies to customer NYALA)

Now, OCBC Mastercard Debit Cards equipped with contactless features for convenience, security and speed of transactions. Here is the important information about OCBC Mastercard Debit Card with Contactless feature/technology:

In using the Contactless feature, make sure the Cardholder himself carries and attaches the card to the EDC Contactless machine and does not hand over the card to the Merchant or any other person.

The Cardholder's error and/or negligence in utilizing this feature and/or misuse of this Contactless feature method is the sole responsibility of the Cardholder, unless proven otherwise.

The Cardholder hereby agrees that any transaction that uses the Contactless feature that has been implemented by the Bank cannot be canceled or changed for any reason.

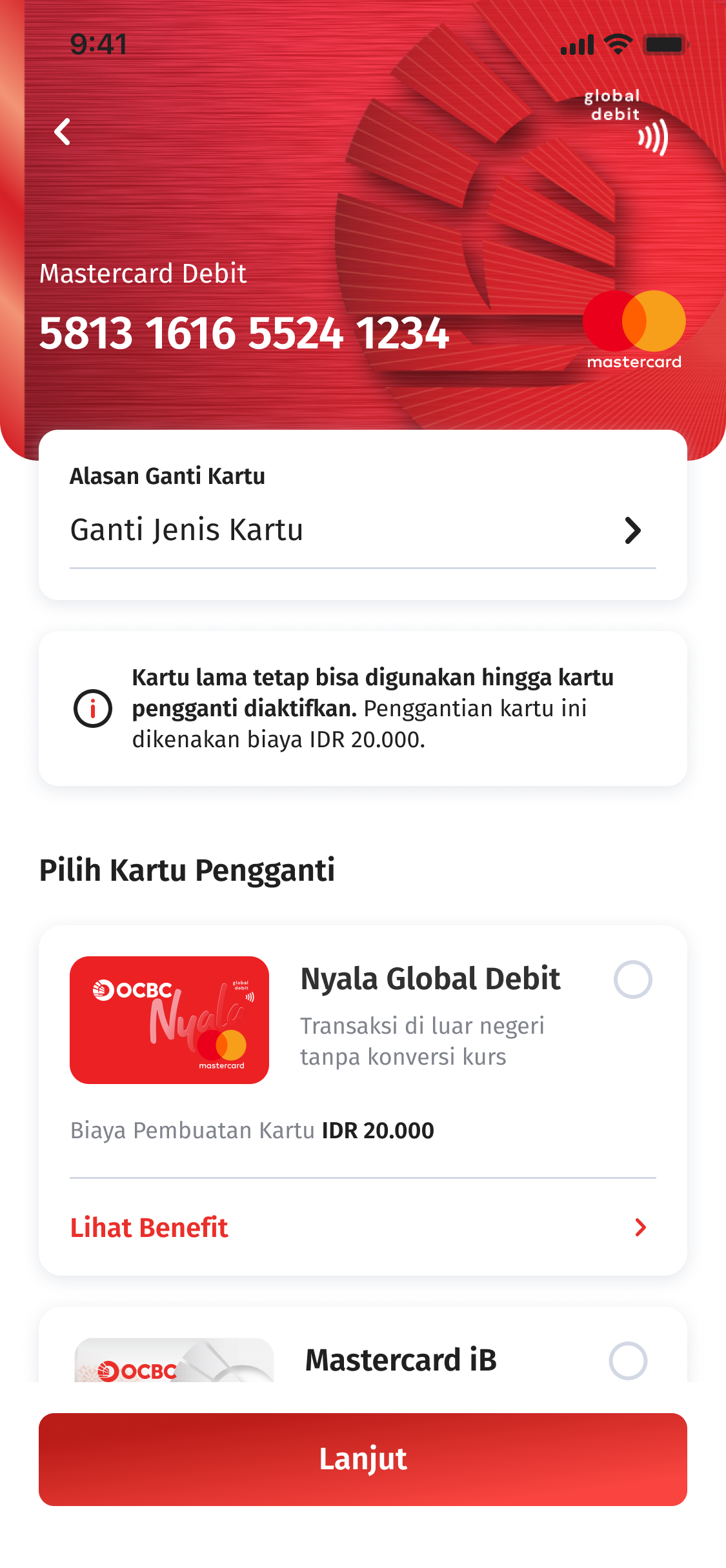

Select Setting Card and click on the card you want change

And choose reason change card

Then select card delivery method

Then click Continue

Change card processed

| Nyala Global Debit Card | |

|---|---|

| Cash withdrawal | IDR 15.000.000/day/account |

| Interbank Transfer | IDR 50.000.000/day/account |

| Shopping Debit | IDR 50.000.000/day/card |

| Book Transfer | IDR 100.000.000/day/account |

| Purchase Payment | IDR 100.000.000/day/card |

| Contactless(Without PIN) | IDR1 mio/transaction/day |

*The limit transaction limit is equivalent to a foreign currency

| NYALA Global Debit Card Transaction Fee | |||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Monthly Admin Card Fee | IDR10,000/card/month (subject to change) | ||||||||||||||||||||||||||||||||||||

| Card Replacement Cost Before Maturity / Expired | IDR40,000 /card (subject to change) | ||||||||||||||||||||||||||||||||||||

| Transactions on ATM |

Cash withdrawal fees changes by OCBC Bank:

|

||||||||||||||||||||||||||||||||||||

| Cash withdrawal feed changed by other international bank ATM owners overseas. The fee is varied and depends on the policy of each bank owning the ATM. This fee is changed by the customer. |

|||||||||||||||||||||||||||||||||||||

| Overseas Transportation Transactions (Aggregate Settlement)

|

Effective 10 August 2023, temporary fund hold will be conducted in an amount corresponding to the currency used for

transaction with the following scheme:

More information regarding transaction settlement process for overseas transportation transactions using OCBC Mastercard Debit Card with contactless and Global Wallet/Global Debit feature can be accessed here |

||||||||||||||||||||||||||||||||||||

Guide

Frequently Asked Questions - Debit Card Settlement for Overseas Transaction

Debit Card, GPN Debit Card, Online Debit Card, OCBC Nyala Global Debit Card, Premier Debit Card

14 Jun 2024 - 31 Jul 2025

90°N Credit Card, OCBC Nyala Platinum, Platinum Credit Card, Titanium Credit Card, Voyage Credit Card, OCBC Nyala Global Debit Card, Premier Debit Card, Online Debit Card, Debit Card

5 Nov 2024 - 31 Mar 2025

OCBC Nyala Global Debit Card, Platinum Credit Card, Titanium Credit Card, OCBC Nyala Platinum, Voyage Credit Card, 90°N Credit Card

10 Sep 2024 - 28 Feb 2025