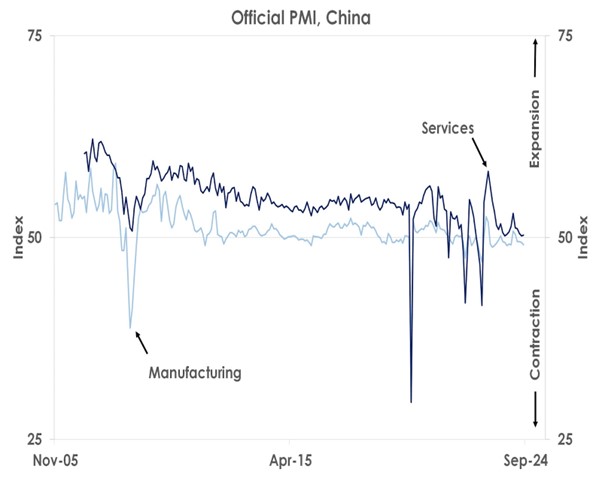

China's August PMI data indicates the current headwinds to growth are continuing. Despite the rate cuts earlier this year, Chief Economist Mansoor Mohi-uddin maintains that more support is necessary for China's flagging financial markets.

August’s PMIs show corporate confidence continues to be lacklustre in China.

Source: Bank of Singapore, Bloomberg

Troublingly, manufacturing PMI fell from 49.4 to 49.1 indicating activity contracted for the fourth month in a row. Bad weather affected the data. But the sector remains hobbled by weak demand.

August’s services PMI improved marginally from 50.2 to 50.3 - above the survey’s key 50.0 level that separates expansion from contraction - but overall demand in the sector stayed subdued. In contrast, when China fully reopened from the pandemic at the start of 2023, services PMI exceeded 58.0 as the chart above illustrates.

Source: Bank of Singapore, Bloomberg

China’s halting recovery from the pandemic since lockdowns were lifted at the end of 2022 has kept inflation low, consumers cautious and property markets still fragile. The second chart shows consumer price index (CPI) inflation was just 0.5% in July.

Source: Bank of Singapore, Bloomberg

August’s PMI data indicate the current headwinds to growth in China are continuing. In response, the People’s Bank of China has already cut interest rates this year as the last chart shows and central and local governments are accelerating bond issuance to fund new investment. But with sentiment weak amongst firms and consumers, we think further rate cuts and fiscal stimulus will be needed to reach this year’s 5% GDP growth target and support China’s flagging financial markets.

This article was first published by Bank of Singapore on 2 September, 2024. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of OCBC Private Bank or its affiliates.

OCBC Private Bank provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC Private Bank is a part of OCBC Group.