Help design the best financial solutions for customers supported by the availability of various products, periodic portfolio reviews and reliable analysis from the Wealth Panel in providing the latest market information

Wealth Management Head

OCBC Indonesia

Wealth Advisory Head

Economist Global Treasury - Research and Strategy

OCBC Indonesia

Head of Investment Strategy

Bank of Singapore

Senior Investment Strategy

OCBC Bank

Head of OCBC Investment Research

Head of Portfolio Management & Research Office

Bank of Singapore

Chief Economist

Head of Treasury Research and Strategy

Head of Greater China Research

OCBC Bank

ASEAN Economist

OCBC

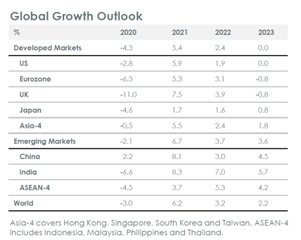

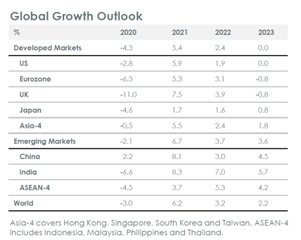

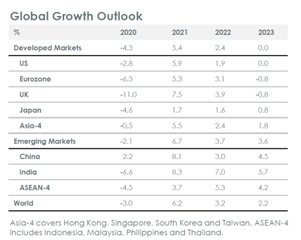

Global policy easing underway.

Global stock market performance in September strengthened. The Dow Jones, S&P 500, and Nasdaq rise by +1.85%, +2.02%, and +2.68% respectively. The Fed's decision to cut interest rates by 50bps to 4.75-5.0% was considered to be quite an aggressive step in implementing policy easing. However, the Fed continues to monitor progress in other economic data which will determine the policy easing that will be taken, both in terms of manufacturing and employment. The S&P global September manufacturing survey was at 47.3, although still in the contraction area but better than the previous month at 47.0. Likewise with employment data, the statistics bureau reported that job growth in September increased by 240k, far above analysts' estimates of 150k, in line with the unemployment rate, which fell back to 4.1%, from the previous period at 4.2%.

Likewise, the bond market, where the 10-year US government bond yield fell by 4.40% throughout September to 3.78%, indicating a significant increase in bond prices. The dovish tone of several Fed officials, regarding the view on the direction of future interest rate policy, boosted the performance of the bond market, along with the August inflation figure report which was much lower than the market consensus at 2.5%.

In contrary with European stock indexes moved variably, the majority recording gains. The EURO STOXX 50 and DAX indices rose 0.86% and 2.21% respectively, while the UK FTSE 100 index weakened -1.67% throughout September. Investor optimism about the continued easing of European monetary policy, as well as the positive influence of the bazooka stimulus issued by the Chinese government, provided encouragement to strengthen the European capital market.

The majority of Asian stocks move higher, as seen from the performance of the MSCI Asia Pacific ex-Japan which appreciated 7.53% throughout September. Several economic stimuli issued by the Chinese government were the main factors driving the strengthening of stocks in the Asian region. Some of the stimuli issued include; cutting the minimum reserve requirement by 50bps before the end of 2024, cutting the 7D reverse repo rate by 20bps to 1.5%, and plans to issue ultra long bonds worth CNY10 trillion (US$1.4T). In addition, the Chinese government has also cut mortgage interest rates, which is expected to increase household savings by CNY150 billion.

Domestically, Bank Indonesia cut its benchmark interest rate by 25bps to 6.00%. The decision is consistent with BI's efforts to keep inflation low and under control in the range of 2.5% ±1%, strengthening and stabilizing the Rupiah exchange rate, and the need for efforts to strengthen economic growth. Likewise, the level of consumer confidence was reported at 124.4, an increase in August from the previous month at 123.4.

Equity

The JCI decline of -1.86% throughout September. Infrastructure and consumer cyclical sectors led the decline by +5.23% and +3.95% respectively. The decline in the JCI was influenced by one of the reasons being the rotation of global investors back to the Chinese stock market, responding positively to the Chinese government's decision to provide large amounts of stimulus to encourage accelerated recovery. In addition, the decision by the FTSE Global Index to remove BREN shares from the index constituents had burdened the decline in the domestic stock exchange.

Bond

The bond market gain in September, as seen from the 10-year Indonesian government yield which fell by 2.72% to 6.45% which indicate an increase in prices. This decrease in yield was also driven by global factors such as a decrease in UST yields and the strengthening of the Rupiah.

The R&I rating agency affirmed Indonesia's Sovereign Credit Rating (SCR) at BBB+, two levels above investment grade, with a positive outlook. R&I believes that Indonesia's economic conditions are supported by increasingly strong fundamental conditions, maintained external resilience, and a low fiscal deficit and government debt ratio.

Bank Indonesia's decision to cut interest rates is considered a pre-emptive action in terms of interest rate policy. BI is taking advantage of the momentum of the Fed's interest rate cut to also carry out monetary easing, which is expected to accelerated economic growth.

Currency

The Rupiah was up on September, as seen from its movement which fell by 2.48% to the range of Rp15,140 per US Dollar (US$). The strengthening of the Rupiah was influenced by the weakening of the US Dollar against global currencies, as seen from the DXY index which fell 0.86% to the level of 101.00 throughout September, in line with the dovish views of Fed central bank officials on interest rate policy.

Going forward, currency volatility still occur, considering the uncertain global economic conditions, especially due to the escalation of armed conflict in the Middle East, which will affect the movement of global oil prices, and is feared to push inflation rates globally again. However, Bank Indonesia is committed to maintain the stability of the Rupiah through several macroprudential policies and payment systems, such as the Domestic Non-Deliverable Forward (DNDF) policy, or the SRBI (Bank Indonesia Rupiah Securities) and SVBI (Bank Indonesia Foreign Exchange Securities) policies to strengthen the pro-market monetary operations strategy for the effectiveness of monetary policy. As one of the tools to strengthen exchange rate stability, foreign exchange reserves appear to remain stable at a high level or US$149.9 billion, which is approaching the record high at US$150.2 billion.

Juky Mariska, Wealth Management Head, OCBC Indonesia

GLOBAL OUTLOOK

Tide of global easing benefits invest markets

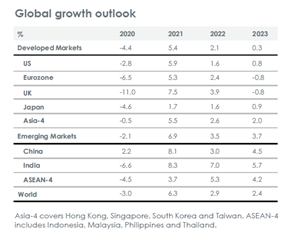

We think the Fed will make 25-basis-point rate cuts at its next four meetings, helping achieve a soft landing in the US. We also see other central banks continuing to reduce interest rates as inflation eases. – Eli Lee

Financial markets continue to make new highs as central banks cut interest rates globally.

In the US, the Fed surprised by reducing its fed funds rate by 50 basis points (bps) in September from 23-year highs of 5.25-5.50%. Officials have become less concerned about inflation as consumer price rises have fallen closer to the Fed’s 2% target. Instead, the risk of rising unemployment pushing the US into a recession spurred the Fed to begin its easing cycle with a large 50bps rate cut.

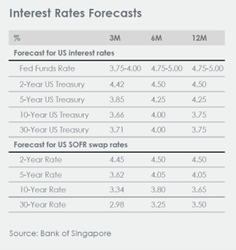

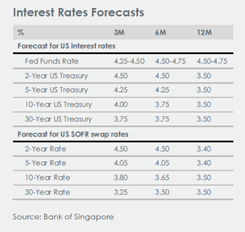

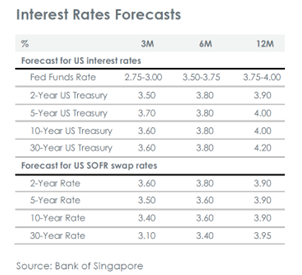

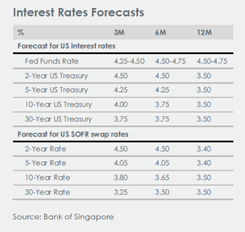

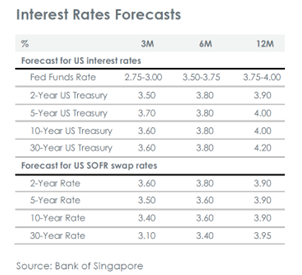

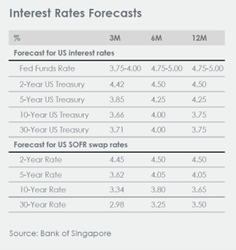

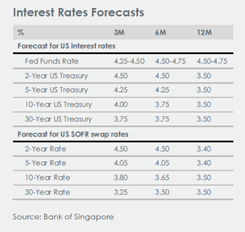

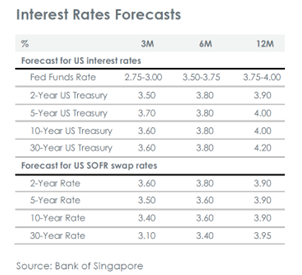

We think the Fed will now follow up its September move by reducing its fed funds rate further by 25bps at each of its next four meetings to March.

The fed funds rate would fall to 3.75-4.00% by then, providing further support to financial markets and helping the US economy achieve a soft landing.

We also see other central banks continuing to cut interest rates as inflation eases. The ECB made its second rate cut of the year in September, lowering its deposit rate by 25bps to 3.50%, and is likely to ease interest rates again in December.

The Bank of England (BOE) began cutting interest rates by 25bps in August from 5.25% and is set to make another 25bps reduction to 4.75% in November.

In addition, the PBOC surprised by reducing its 7-day reserve repo rate from 1.70% to 1.50% as part of a broader stimulus package to support growth, real estate and equity markets.

We think investors should maintain a modestly Overweight stance towards risk assets given the tide of monetary easing. But we recognise risks remain this year including the Middle East wars, geopolitical tensions and the US elections. If a new president follows more inflationary policies, then the Fed may be forced to stop cutting interest rates next year to the detriment of financial markets.

US – Fed starts easing with a large 50bps rate cut

The Fed surprised by starting its easing cycle with a 50bps cut in its fed funds rate from 5.25-5.50%

to 4.75-5.00% rather than by 25bps as widely expected by investors.

Chairman Powell justified the decision by arguing the Fed wanted to ensure US employment stayed firm after weakening recently: “the labour market is actually in solid condition, and our intention with our policy move today is to keep it there.”

The unemployment rate has increased from five-decade lows of 3.4% last year to 4.2% now after the Fed aggressively raised interest rates in 2022 and 2023 to curb inflation. The labour market slowdown over the course of this year has made officials wary that a further increase in unemployment now could cause the economy to tip into a recession.

The Fed Chair also said the 50bps rate cut reflected officials’ “confidence that inflation is coming down toward 2% on a sustainable basis.”

Core inflation excluding volatile food and energy prices, has fallen sharply from its four-decade highs above 6% in 2022 when the US fully reopened from the pandemic. Thus, with officials more worried about unemployment and less concerned by inflation, the Fed chose to start off rate cuts with a larger than expected 50bps reduction.

The Fed, however, did not signal its intention to keep cutting rates by 50bps in the future. Its forecasts imply 25bps rate cuts at November’s and December’s meetings and a further four 25bps reductions next year.

We also see the Fed slowing down the pace of its rate cuts as the economy seems unlikely to suffer a recession this year. We thus expect the central bank will cut interest rates by 25bps at its next four meetings to March as inflation keeps falling, rather than repeating September’s large 50bps move.

Over the next few months, further Fed rate cuts should thus keep supporting risk assets. But beyond March, additional rate cuts will depend on the US elections. If a new president follows more inflationary policies, the Fed may be forced to stop cutting rates after March - to the detriment of financial markets.

China – Major stimulus from the PBOC

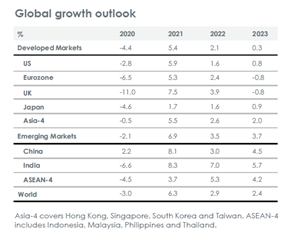

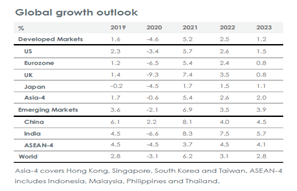

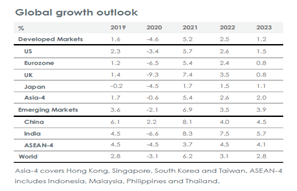

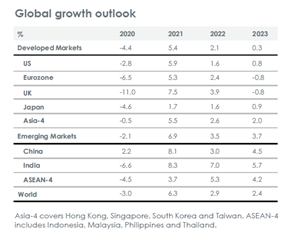

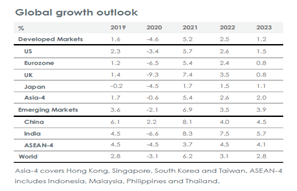

Following weak data that showed China’s recovery from the pandemic continues to slow as consumers stay cautious and the property markets stays fragile - we downgraded our economic growth forecasts for this year to 4.7% from 5% previously. However, the PBOC has since surprised by announcing several steps to support growth.

First, the PBOC cut key interest rates. Its 7-day reverse repo rate was reduced by 20bps to 1.50% and the 1Y Medium-term Lending Facility (MLF) rate was lowered by 30bps to 2.00%. Second, banks’ reserve requirement ratios (RRR) were reduced by 50bps to 9.50% to free up an estimated CNY1t of liquidity. Third, to support the property market, interest rates on current mortgages were cut by 50bps and downpayment ratios for second property purchases were reduced from 25% to 15%. Fourth, to support equities, the PBOC will set up a new CNY500b facility to allow insurers, funds and brokers to borrow directly from the central bank to invest in shares. The PBOC will also set up a re-financing facility for banks to aid firms’ share buybacks.

The monetary action by the PBOC is striking and shows officials still aim to hit this year’s GDP target of “around 5%” growth. We expect further fiscal easing will be announced to boost demand and curb the risks of deflation. Investors are thus likely to keep reacting positively as officials show determination to support growth this year.

Europe – Further rate cuts needed to support

In September, the ECB, as widely expected, reduced its deposit rate by 25bps for the second time this year from 3.75% to 3.50% and signalled further cuts were likely.

We think the ECB will keep reducing interest rates each quarter by 25bps as inflation continues to fall with the next cut likely in December. But next year the ECB may speed up its rate cuts if Eurozone growth stagnates rather than rebounds. The central bank may thus start reducing interest rates at each meeting from January onwards.

In contrast, the BOE seems more wary of inflation. Last month, it kept its Bank Rate at 5.00% after making its first cut in four years in August. Officials still intend to lower interest rates, but warned future cuts may only be gradual. We expect the BOE will cut again by 25bps in November to 4.75% as UK inflation at 2.2% is near its 2% target. But we expect the BOE will only keep easing by 25bps each quarter in 2025 as core inflation is higher at 3.6%. The BOE’s gradual approach should thus benefit the Pound.

Japan – Further interest rate rises are likely

In September, the Bank of Japan (BOJ) left its overnight call rate unchanged at 0.25% after making its second hike of the year in July. But officials signalled interest rates are likely to rise further as inflation is anticipated to keep firming. Governor Ueda said the BOJ would raise rates again if its outlook was achieved. We think this is likely as Japan’s core inflation rate in August picked up to 2.1% above the BOJ’s 2% target.

As with the Pound, we expect the Yen is set to benefit as we think the BOJ is likely to increase interest rates again in December to 0.50% to curb inflation. We thus continue to see the currency rebounding against the US Dollar to 140 over the next year, helped by the Fed also cutting interest rates further in 2024 and 2025.

EQUITIES

Remain constructive

We remain constructive on equities though volatility may rise as we approach the US elections. Our Overweight rating in equities is led by Asia ex-Japan where we favour Hong Kong/China, India, South Korea, Indonesia, and Singapore equities. – Eli Lee

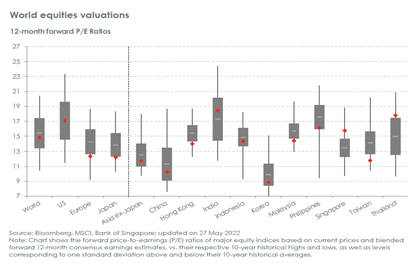

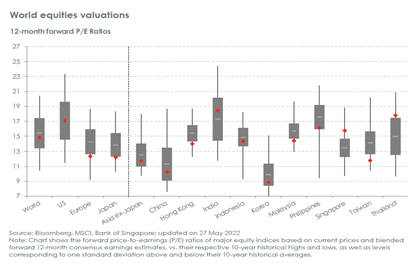

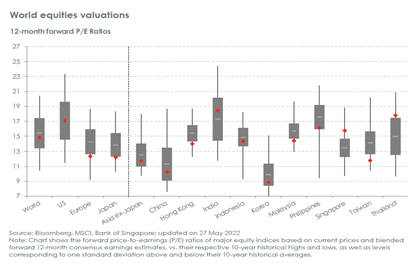

US and European equities are once again near all-time highs, having cautiously climbed their way up over the past few months, with broadly better performance in the more defensive segments of the market. However, after the US Federal Reserve’s (Fed’s) rate cut in September, should there be incremental hopes of a soft landing, we may start to see a shift in the balance of risks incrementally towards more cyclical sectors. For this to be sustained, an improvement in the earnings momentum has to come in as well, especially in places such as Europe where we have seen deteriorating earnings momentum in cyclicals.

Hong Kong/China equities, however, have seen a significant shift in sentiment to one that is risk-on, after the series of coordinated policies and easing measures that exceeded most expectations. In fact, the last week of September was the best week in Chinese equities in 16 years. This will remain the focus of investors’ attention ahead, as well as the upcoming US elections.

Overall, we maintain our Overweight position on the overall equities asset class, led by our Overweight stance on Asia ex-Japan equities, where we are positive on India, Hong Kong/ China, Indonesia, South Korea and Singapore equities.

US – A beneficiary of the Fed rate cut cycle

US equity markets were boosted by the Fed’s move to begin its rate cut cycle with a 50bps reduction in the fed funds rate from 5.25-5.50% to 4.75-5.00% in September. As rates fall and borrowing costs are lowered, corporate profitability should improve, especially for medium- and small-cap companies. This is also in-line with our expectation that the rally will broaden out beyond the mega-cap names into other sectors. Historically, equity price-to-earnings (P/E) multiples also tend to be supported during rate cuts if there is no recession, which is our base case. However, we are also cognisant of several risks on the horizon. Volatility could ensue in the coming weeks as investors could look to lock in profits heading into the US presidential elections. Also, depending on the outcome, there is a possibility of corporate tax increases, which could be an incremental headwind to earnings per share (EPS) growth for companies.

From the latest earnings season, we note that consumers are increasingly value-conscious in their spending while others have also been downtrading. We will be watching out for improvements in consumption sentiment, especially if lower rates and a soft macro landing translates into a more favourable outlook for discretionary consumption.

Europe –Draghi’s report is out; now Europe must come together

Given long-standing concerns of Europe’s competitiveness and strategy for the future, one of the most significant recent developments was the release of Mario Draghi’s long-anticipated report, “The Future of European Competitiveness”. Slow productivity growth over the last 20 years has been identified as the root cause of Europe’s structural challenge, and this has to be tackled in sectors where productivity has been lagging. Thus, actionable policy proposals were recommended for various sectors, of which important thrusts include leveraging on the large single European market to increase bargaining power, as well as standardising equipment and processes for economies of scale. Importantly, total annual additional investment needs came up to EUR750-800b. However, the report comes at a time when political polarisation has increased. Countries need to come together to think for the whole region, and we expect serious work from the new European Commission to start in early 2025, as time is needed for all new Commissioners to be approved by Parliament.

Japan – Keeping a watchful eye on macro events

he MSCI Japan Index underperformed the broader equity markets for the month of September. We believe there are near-term uncertainties over Japanese equities due to currency volatility, central bank policy action and geopolitical risks. Investors would have to deal with not just the US presidential election but also local elections (first with Ishiba winning the Liberal Democratic Party election and then the general election to follow). We note that the rolling 12-month correlation between the USDJPY and the MSCI Japan Index has increased sharply since July this year.

We update our earnings growth assumptions and continue to forecast below-consensus EPS growth. We see downside risks to the street’s projections due to the recent steep appreciation in the Yen from mid-July to mid-September, although the currency did see some weakening following the 50 basis points rate cut by the Fed in September.

Asia ex-Japan – Levers pulled to support the capital markets

The MSCI Asia ex-Japan Index saw a firm rebound in September due to the bonanza of policy easing measures announced by the Chinese government. Besides China, we also saw some other governments in the region introducing measures to support capital markets. In Thailand, the government has rolled out the Vayupak Fund, which plans to invest in constituents of the Stock Exchange of Thailand 100 Index or other local stocks with high ESG scores. Investors in the fund will receive principal protection and are guaranteed an annual return of at least 3% for 10 years, but returns are capped at 9%. South Korea has also stepped up on its Value Up Programme, with tax amendment proposals announced and the Korea Exchange unveiled its Value-Up Index, with selection criteria being high price-to-book (P/B) stocks and inclusion priority is given to companies with Value-Up initiatives.

China/HK – Half time reality check

The Hong Kong and Chinese markets saw significant rallies on the back of the policy stimulus focusing and the unusual September Politburo meeting signalling a policy pivot. The coordinated rate cuts and easing measures came in stronger-than-expected. The stock market stabilisation policy and the explicit mention to “stop housing price decline” also exceeded market expectations, signalling the urgency and determination of policymakers to support growth and fighting deflation. We see upside risk should meaningful fiscal stimulus measures follow up as the implementation details have yet to be announced at the time this was written.

We believe the monthly changes to the People’s Bank of China’s (PBOC) balance sheet and leverage would be key indicators to monitor given that the PBOC will grant loans to both banks and non-banking financial institution (NBFI). We believe brokers and exchanges would be key beneficiaries, along with major index-heavy stocks that have improving earnings outlook, such as key internet and platform companies. We maintain our preference for (i) quality yield stocks despite some recent rotation, as well as (ii) market leaders and reform beneficiaries.

Global Sectors – Fed’s pivot continues to be a key driver for now

Over the past month, the Utilities and Communication Services sectors continued to perform relatively well but it was the Consumer Discretionary sector that has outperformed most as of the time of writing. We continue to believe that amidst the Fed rate cuts and potential volatility leading up to the US election, segments such as REITs, utilities, and biotechnology are relatively well-positioned, and the former two sectors also lend an element of defensiveness during times of uncertainty.

Divergence in Energy and Materials sectors

Meanwhile, although both the Energy and Materials sectors normally move quite closely together, they are now diverging in terms of price performance. The former is underperforming due to concerns of lower oil prices due to an oversupply, and especially on the back of reports that Saudi Arabia is considering returning to its strategy of pursuing market share rather than supporting oil prices. On the other hand, China’s stimulus blitz has injected optimism in the metals markets, supporting share prices of mining companies as well.

Large boost for China internet

Over in Technology, China internet names re-rated significantly in September, catalysed by the stimulus blitz by policymakers in China. We remain constructive on the prospects of online games and local services companies, while selected e-commerce names could benefit from potential market share gains.

In Developed Markets, concerns continue to linger about technology export restrictions and the longevity of the artificial intelligence (AI) trade. We continue to be constructive on the prospects of a number of Big Tech names but believe the broadening rally should also be beneficial to other semiconductor/hardware/ software stocks too. However, we continue to be cautious in the near-term on analog semiconductors, as some end-markets might still require more time for fundamentals to turn around.

BONDS

Upgraded from Neutral to Overweight

We now have an overall Overweight stance in fixed income via our Overweight positions in Emerging Markets (EM) High Yield bonds. We have moved the Underweight in EM Investment Grade bonds to Neutral as rate cuts will be a positive tailwind. – Vasu Menon

While the economic backdrop is reasonably robust, we remain watchful of potential volatilities in the coming weeks. With lower interest rates expected as we head into year end, we think current yield levels are reasonably attractive and may not be sustained for much longer. We are Neutral on Developed Markets (DM) Investment Grade (IG) and DM High Yield (HY) bonds.

In Emerging Markets (EM), we move IG to Neutral (from Underweight) and maintain an Overweight in HY. We remain Neutral on duration, preferring the front-end and intermediate maturities.

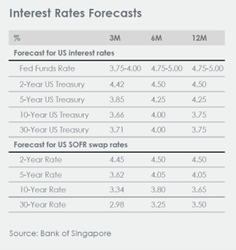

Rates and US Treasuries

The Fed delivered a 50 basis points (bps) rate cut in the September Federal Open Market Committee (FOMC) meeting, with a larger-than-expected move justified by the slowing labour market and the confidence that inflation would reach the Fed’s 2% goal. More importantly, the Fed’s new forecast implied only 25bps cuts in future. As a result, 10Y US Treasury (UST) yields were modestly higher post-rate cut and the 2Y/10Y US Treasury curve further steepened.

With the Fed acknowledging further progress on price stability, focus will now shift towards the other side of the Fed’s dual mandate – employment.

The market is pricing in about 200bps of cumulative cuts over the next 18 months. At the same time, however, we remain cautious of upside risks to the inflation impulses (driven by tariffs, tax breaks or fiscal stimulus) resulting from the US presidential election in November. This could raise the outlook for upside surprises on inflation further down the road.

Reflecting these expectations, we maintain a Neutral position on duration. We view the front and intermediate term as offering the best protection from rates volatility.

Developed markets

Fed cuts in a non-recessionary environment should garner inflows into credits, as it presents investors with a chance to lock in yields as the global easing cycle begins. If incoming data continues to validate a soft-landing outcome, spreads could remain tight. At this point, the clearest risk is a quick deterioration in the labour market. While that could trigger more aggressive Fed cuts, it could also be a headwind for spreads, likely resulting in modest total returns. Hence, we reiterate our preference for defensive positioning by staying up in the quality curve.

Emerging markets

We have a modest Overweight stance on EM credits, with a preference for HY over IG. EM IG should benefit from the lower rate tailwind during the rate cut cycle. We remain Overweight in EM HY due to the attractive carry returns.

Asia

In line with overall EM views, we are Neutral Asia IG and Overweight Asia HY. For Asia IG, its comparatively shorter duration, stable fundamentals and lower market beta should keep spreads range bound. We continue to like the attractive carry for Asia HY.

We maintain our overall Neutral view on China credits and prefer to stay with quality names.

FX & COMMODITIES

Gold price forecast raised

We have raised our 12-month price target for gold to US$2,900/ounce from US$2,700/ounce. The decline in short-term interest rates is set to drive greater investment demand for gold. Emerging Markets central banks’ demand for gold is also likely to remain strong amid heightened geopolitical risk and concerns over US debt sustainability. – Vasu Menon

Oil

Oil prices fell on worries of increased supply as Libya's two legislative bodies agreed in September to appoint jointly a central bank governor, defusing a battle for control of the country's oil revenue and potentially quickening the return to 1 million barrel per day of Libyan oil production.

Oil sentiment took a further hit after the Financial Times reported that Saudi Arabia is considering going ahead with its planned production hikes in December. The report also suggested that the OPEC producer was ready to abandon its US$100/barrel (bbl) price forecast to take back market share. Such a move would raise concerns that OPEC could pull back from the supply agreements that have helped stabilise the oil market and support prices.

Concerns that OPEC is all out to win market share are likely overdone as we do not believe a price war is in OPEC’s interests. The battle for market share is just one of degree, with OPEC likely to initiate a gradual phase-out of additional voluntary adjustments in December but could yet pause if Brent oil price sinks far below US$70/bbl.

We project Brent prices will likely be anchored around the mid-USD70s/bbl in a year’s time as we expect OPEC+ to continue to play a key balancing role. Chinese announcements of new economic stimulus should help ease concerns over weak Chinese oil demand.

Precious metals

We have raised our 12-month price forecast for gold to US$2,900/ounce from US$2,700/oz. Two reasons are behind the higher gold price target.

First, the faster decline in short-term interest rates both in the West and in China is set to drive greater investment demand for gold, which is showing up in the renewed rise in gold ETF holdings since 2Q24. The eventual magnitude of rate cuts may differ, but more Western central banks are likely to move towards rate cuts at every other meeting. The latest central bank that could soon pivot to cuts at every meeting is the European Central Bank (ECB).

Second, Emerging Markets central banks’ demand for gold is likely to remain strong amid heightened geopolitical risk and concerns over US debt sustainability. In addition to the ongoing drawn-out Russia-Ukraine conflict, tensions have risen sharply in the Middle East as the conflict between Israel and Hezbollah escalates. The US fiscal situation is unlikely to inspire a lot of confidence in the US Dollar (USD) no matter who wins the US presidential race. As the US issues more debt to finance its growing budget deficits, concerns over the USD losing its shine as all mighty reserve currency are likely to continue to benefit gold. Gold is money that governments cannot debase.

Currency

The US Dollar (USD) closed lower for a third consecutive month in September. The US Federal Reserve (Fed) delivered a surprise 50 basis points (bps) rate cut at its September policy meeting and its dot plot implied another 50bps in cuts for the rest of this year. Fed Chairman Jerome Powell has cautioned against assuming more 50bps rate cuts at future meetings, and he does not appear worried or panicky about the economy. With a refreshed dot plot guidance, we expect markets to shift their focus towards watching the momentum of US economic growth. If Fed cuts rates even though the US is not in a recession, and if growth outside the US remains decent, this could disadvantage the USD. We maintain our view for the USD to trend lower as the Fed’s rate cut cycle continues. Some risks to watch include the US election outcome in November, global growth momentum and geopolitical risks.

Meredam Kekhawatiran Pertumbuhan Ekonomi

Wall Street sepanjang bulan Agustus berhasil mencatatkan penguatan dengan ketiga Indeks utama Dow Jones Indistrial Average, S&P 500, dan NASDAQ composite masing-masing meningkat sebesar 1.76%, 2.28%, dan 0.65%. Musim laporan keuangan korporasi Q2-2024 telah mencapai puncaknya di akhir bulan Agustus kemarin. Berdasarkan data Factset untuk earnings Q2-2024 tercatat sebanyak 79% perusahaan yang tergabung dalam indeks S&P 500 telah berhasil melaporkan kinerja keuangan Q2-2024 yang melebihi ekspektasi, dan 60% diantaranya melaporkan pendapatan di atas ekspektasi. Hal ini yang mendorong penguatan untuk bursa saham AS secara keseluruhan di bulan Agustus lalu dan juga kinerja sektor teknologi yang membaik setelah pada perdagangan bulan sebelumnya mengalami penurunan yang signifikan.

Di pertemuan Jackson Hole, Jerome Powell meredam kekhawatiran pelaku pasar dengan pernyataan yang mengindikasikan pelonggaran kebijakan bank sentral akan segera dimulai. Kini, perhatian pelaku pasar saat ini tertuju pada kebijakan suku bunga Federal Reserve, dimana berdasarkan konsensus Bloomberg, diprediksi The Fed akan memangkas suku bunga acuan untuk pertama kalinya sejak tahun 2022 lalu. Hal ini juga didukung oleh rilisan angka inflasi AS untuk bulan Juli yang kembali menurun dari level 3% ke level 2.9% dan yang terbaru adalah data Core PCE Price Index AS untuk bulan Juli yang sesuai ekspektasi berada pada level rendah yaitu 0.2%.

Di Asia, pemulihan perekonomian China terlihat masih berlangsung sampai dengan saat ini, terlihat dari beberapa indikator utama seperti Caixin Manufacturing PMI bulan Agustus yang telah berada pada zona ekspansi 50.4, meningkat jika dibandingkan dengan periode sebelumnya di level kontraksi 49.8. Selain itu pula, industrial profit China untuk bulan Juli meningkat dari level 3.5% ke level 3.6%. Sementara itu, pemerintah China tetap berkomitmen untuk mendukung perekonomian dengan kebijakan yang akomodatif, diantaranya dengan mempertahankan tingkat suku bunga dasar pinjaman atau loan prime rate yang rendah di bulan Agustus ini, baik untuk tenor satu maupun lima tahun di level 3.35% dan 3.85%.

Beralih ke domestik, neraca perdagangan Indonesia untuk bulan Juli kembali dirilis surplus sebesar US$ 470 juta dengan ekspor yang meningkat di level 6.46% dan impor yang juga meningkat di level 11.07%. Kenaikan neraca perdagangan ini menjadikan kenaikan untuk 51 bulan secara berturut-turut. Selain itu, tingkat inflasi domestik pada bulan Agustus berada di level 2.12% dalam setahun terakhir, lebih rendah jika dibandingkan periode sebelumnya di level 2.13%, di tengah beberapa harga pangan dan komoditas yang cukup terkendali. Dari sisi kebijakan moneter, Bank Indonesia memutuskan kembali mempertahankan tingkat suku bunga acuan di level 6.25% pada bulan Agustus lalu. Bank Indonesia menilai keputusan tersebut memadai untuk menjaga stabilitas nilai tukar Rupiah dan terbukti rilisan angka inflasi Indonesia untuk bulan Agustus kembali menurun ke level 2.12% y-o-y, sedangkan sebelumnya berada di level 2.13%.

Equity

Bursa saham IHSG kembali mencatatkan kenaikan sebesar 5.72% sepanjang bulan Agustus. Saham di sektor konsumsi siklikal dan sektor properti memimpin penguatan masing-masing sebesar 20.41% dan 12.62%. Penguatan pasar saham di bulan Juli didorong salah satunya dari aliran dana asing yang sepanjang bulan Agustus telah masuk lebih dari US$ 1.84 miliar. Ekspektasi pemangkasan suku bunga Fed yang lebih agresif turut mendorong ekspektasi investor bahwa Bank Indonesia dapat segera memangkas suku bunga acuan. Tingkat suku bunga yang lebih rendah akan memberikan sentimen positif untuk pertumbuhan ekonomi Indonesia. Ada beberapa indikator yang dapat dijadikan tolak ukur seperti pertumbuhan pinjaman atau loan growth untuk bulan Juli yang meningkat dari level 12.3% ke level 12.4% dan juga penjualan ritel Indonesia di bulan Juni yang semakin bertumbuh ke level 2.7%, dari sebelumnya di level 2.1%.

Bond

Pergerakan pasar obligasi di bulan Agustus cenderung menguat, terlihat dari pergerakan imbal hasil pemerintah Republik Indonesia tenor 10 tahun yang mengalami penurunan sebanyak -3.89% menjadi 6.63%, yang artinya terjadi kenaikan dari sisi harga. Penurunan imbal hasil ini mengikuti imbal hasil acuan US Treasury 10 tahun, yang turun dari 4.02% ke level 3.90% di akhir bulan Agustus. Penurunan imbal hasil ini juga didorong dari aktifitas inflow aliran dana asing ke pasar obligasi Indonesia yang tercatat mencapai US$ 1.31 miliar. Selain itu pula, kenaikan minat investor turut didukung oleh nada kebijakan bank sentral Fed yang mengindikasikan akan segera memangkas suku bunga acuan pada pertemuan bulan September ini (dovish). Ketertarikan dan keyakinan investor asing untuk terus berinvestasi Indonesia juga didukung oleh sentimen positif yang datang dari salah satu lembaga pemeringkat rating Internasional yaitu S&P yang telah mengafirmasi souverign credit rating Republik Indonesia pada peringkat BBB, satu tingkat di atas investment grade, dengan outlook stabil pada 30 Juli 2024. Hal ini juga memberikan pandangan bahwa perekonomian Indonesia masih berada pada level kondusif.

Currency

Mata uang Rupiah kembali bergerak menguat sepanjang bulan Agustus, terlihat dari pergerakannya yang menurun sebanyak 5.21% sepanjang bulan Agustus ke kisaran Rp 15,455 per Dolar AS (USD). Hal ini didukung oleh adanya signal yang semakin jelas dari ketua Federal Reserve Jerome Powell untuk segera memangkas suku bunga acuan pada pertemuan di bulan September ini. Selain itu, dalam pertemuan Jackson Hole pada akhir bulan Agustus kemarin, Jerome Powell menyatakan bahwa “cut off is on the table” yang mengisyaratkan kepastian akan pemangkasan. Selain itu, neraca perdagangan kembali mengalami surplus pada bulan Agustus 2024 sebesar USD 150.2 miliar, meningkat dari periode sebelumnya di level US$ 145.4 miliyar. Selain itu, posisi cadangan devisa ini setara dengan pembiayaan 6.7 bulan impor atau 6.5 bulan impor dan pembayaran utang luar negeri pemerintah, serta berada di atas standar kecukupan internasional sekitar 3 bulan impor. Kenaikan cadangan devisa berasal dari penerimaan pajak dan jasa, penerimaan devisa migas, dan kenaikan penarikan pinjaman luar negeri pemerintah.

Juky Mariska, Wealth Management Head, OCBC Indonesia

GLOBAL OUTLOOK

Volatilitas pasar keuangan lantaran kekhawatiran AS akan mengalami resesi. Namun, kami melihat bahwa investor tidak perlu khawatir dengan kondisi perlambatan ekonomi AS karena sebagian besar data masih konsisten dengan skenario soft landing. – Eli Lee

Pasar keuangan saat ini menunjukkan volatilitas yang didorong oleh kekhawatiran resesi di AS, stagnasi ekonomi Eropa, dan perlambatan pertumbuhan di China. Namun, kami melihat bahwa investor tidak perlu terlalu khawatir dengan hal ini.

Pertama, rilisan data ketenagakerjaan dan inflasi terakhir menunjukkan adanya perlambatan ekonomi AS. Namun, sebagian besar data masih konsisten dengan skenario soft landing, bukan kontraksi ekonomi yang signifikan.

Selain itu, dengan tingkat inflasi yang mendekati target 2%, The Fed telah memberikan sinyal kuat bahwa mereka akan mulai memangkas suku bunga. Kami memperkirakan The Fed akan menurunkan suku bunga acuan sebesar 25 basis poin (bps) sebanyak dua kali pada bulan September dan bulan Desember yang akan berdampak positif pada aset berisiko.

Kedua, data PMI menunjukkan bahwa sentimen bisnis di Eropa masih menunjukkan kegiatan yang ekspansif dibantu oleh kebijakan pemerintah, yaitu penurunan suku bunga oleh European Central Bank (ECB) dan Bank of England (BoE).

Kami juga memperkirakan ECB yang telah menurunkan suku bunga deposito dari 4.00% menjadi 3.75% pada bulan Juni, akan kembali menurunkan suku bunga sebesar 25 bps masing-masing pada bulan September dan Desember, seiring dengan turunnya inflasi zona Eropa menuju target 2%. BoE juga diperkirakan akan melanjutkan pemangkasan suku bunga sebesar 25 bps pada bulan November, setelah sebelumnya menurunkan suku bunga dari 5.25% menjadi 5.00% pada bulan Agustus dengan inflasi Inggris yang mendekati target 2%.

Ketiga, terdapat keraguan bahwa China dapat mencapai target pertumbuhan PDB sebesar 5% karena masyarakat masih berhati-hati dalam melakukan konsumsi, dan masih lemahnya pasar properti. Namun, pelonggaran kebijakan fiskal dan moneter lebih lanjut bisa mendukung aktivitas ekonomi China tahun ini.

Terakhir, penguatan pada ekonomi Jepang selama Q2-2024, didorong oleh kenaikan upah yang melampaui inflasi dengan harapan dapat meningkatkan daya beli konsumen.

Dengan demikian, kami menyarankan investor agar tetap mempertahankan posisi Overweight pada kelas aset saham. Sebaliknya, kami tetap Neutral pada aset pendapatan tetap melihat pemilu AS yang berpeluang membuat inflasi kembali naik di tahun 2025.

AS – Soft landing berpotensi terjadi dibandingkan resesi

Kekhawatiran investor terhadap resesi AS muncul setelah laporan ketenagakerjaan bulan Juli memperlihatkan lonjakan pekerja hanya sebesar 114,000, sementara tingkat pengangguran naik dari 4.1% menjadi 4.3%. Level ini meningkat dari level terendah dalam lima dekade di 3.4% pada tahun 2023. Namun, kami melihat rilisan data tersebut dipengaruhi oleh Badai Beryl, yang menyebabkan 436,000 pekerja tidak dapat bekerja karena cuaca buruk.

Meningkatnya pengangguran kembali menimbulkan kepanikan investor, sejalan dengan peringatan dari indikator ‘Sahm Rule’. Indikator ini memprediksi resesi akan terjadi jika rata-rata pengangguran dalam tiga bulan meningkat 0.5% dari titik terendah dalam 12 bulan terakhir. Namun, kami juga melihat bahwa peningkatan pengangguran tersebut bukan terjadi karena adanya lonjakan pekerja baru, namun lebih disebabkan adanya kenaikan pekerja imigran.

Kami berpendapat bahwa di tahun ini, perekonomian AS lebih berpotensi terjadi soft landing daripada resesi, dimana akan lebih mendukung kinerja aset berisiko. Pemantau PDB dari bank sentral regional menunjukkan bahwa ekonomi masih tumbuh pada laju 2% dari tahun ke tahun.

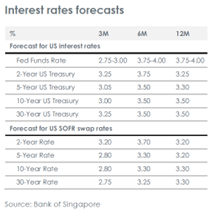

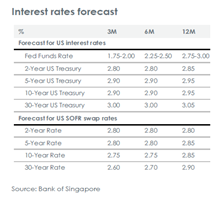

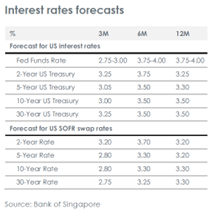

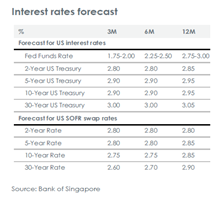

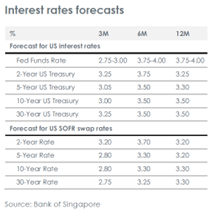

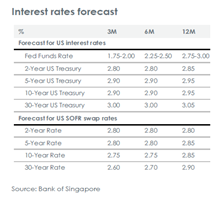

Kami telah memperbarui proyeksi imbal hasil US Treasury untuk memperhitungkan pemangkasan suku bunga The Fed. Kami memperkirakan imbal US Treasury akan bergerak menuju bentuk kurva normal, dengan pergerakan imbal hasil obligasi jangka pendek (2 tahun) menuju level rendah, dan bergerak di bawah imbal hasil jangka panjang (10 tahun dan 30 tahun) seiring pelonggaran kebijakan The Fed. Oleh karena itu, preferensi kami berada pada obligasi dengan jatuh tempo yang lebih pendek. Sebaliknya, kami khawatir bila tingkat inflasi akan meningkat jika mantan Presiden Donald Trump kembali memimpin. Dengan demikian, kami tetap mempertahankan proyeksi imbal hasil obligasi 10 tahun di level 4.25% dalam 12 bulan ke depan dan mempertahankan posisi neutral terhadap pasar obligasi.

China – Sulit mencapai target pertumbuhan sebesar 5% di tahun ini

Pertumbuhan awal tahun yang baik, dengan PDB bertumbuh 1.5% secara kuartalan (QoQ) dan 5.3% secara tahunan (YoY) pada Q1-2024, ekonomi China kemudian mengalami perlambatan dengan bertumbuh 0.7% secara kuartalan dan 4.7% secara tahunan selama Q2-2024, sehingga meningkatkan risiko bahwa pemerintah gagal mencapai target pertumbuhan PDB setahun penuh “sekitar 5%” di tahun 2024.

Data bulan Juli mengawali lemahnya pertumbuhan Q3-2024. Supply China masih solid dengan kenaikan produksi industrial 5.1% YoY. Demikian pula, investasi manufaktur menguat, naik 9.3% YoY ditahun ini dan ekspor naik 7.0% YoY. Namun, permintaan secara keseluruhan masih tertekan oleh konsumen yang tetap berhati-hati setelah pandemi. Oleh karena itu, meskipun penjualan ritel di bulan Juli meningkat dari 2.0% YoY menjadi 2.7% YoY namun masih lemah.Kurangnya kepercayaan konsumen masih terlihat pada lemahnya permintaan kredit baru oleh rumah tangga dan perusahaan. Pada bulan Juli, pertumbuhan kredit hanya tercatat 8.2% YoY, jauh dibawah level sebelum pandemi. Kehati-hatian konsumen juga didorong oleh lemahnya sektor properti. Investasi properti di bulan Juli pada tahun ini kembali turun lebih dari 10% YoY.

Mengawali Q3-2024 dengan lemah membuat target PDB China terancam. Diperlukan stimulus yang lebih lanjut agar target pertumbuhan masih dapat tercapai. Oleh karena itu, sampai dengan penghujung tahun, kami memperkirakan People's Bank of China (PBOC) akan menurunkan suku bunga lagi sebesar 10-20 bps setelah sebelumnya sudah dilakukan pada bulan Juli, penerbitan obligasi pemerintah untuk mendanai investasi akan meningkat, dan juga stimulus fiskal baru pada sektor konsumsi dan properti, untuk mendukung pasar saham domestik China.

Eropa – Sentimen bisnis yang tangguh dapat meredam kekhawatiran terhadap pertumbuhanPertumbuhan PDB sebesar 0.3% QoQ pada Q1-2024, merupakan awal yang baik bagi perekonomian Eropa, namun setelahnya kekhawatiran resesi kembali meningkat. Rilisan data selama Q2-2024 menunjukkan bahwa zona Eropa berekspansi sebesar 0.3% QoQ. Sehingga, kami berpendapat PDB zona Eropa masih berada di jalur yang tepat untuk bertumbuh sebesar 0.7% pada keseluruhan tahun 2024 dan 1.5% pada tahun 2025. Sangat kontras dengan pertumbuhan pada 2023 yang hanya sebesar 0.5% saja.

Penguatan dan ketangguhan aktivitas bisnis mendukung pasar keuangan lokal. PMI bulan Agustus menunjukkan kepercayaan perusahaan naik untuk pertama kalinya dalam enam bulan terakhir. Selain itu, penurunan inflasi akan membuat ECB kembali menurunkan suku bunga. Kami memperkirakan ECB – setelah dua kali pemangkasan di bulan Juli dan September sebesar 50 bps suku bunga deposito dari 4.00% menjadi 3.5% – akan kembali melakukan pemangkasan suku bunga lebih lanjut sebesar 25 bps bulan Desember. Demikian pula, BoE diperkirakan akan menindaklanjuti penurunan suku bunga sebesar 25 bps dari 5.25% menjadi 5.00% di bulan Agustus dengan 25 bps lagi di bulan November seiring dengan meredanya inflasi di Inggris.

Jepang – Pertumbuhan lebih kuat namun kondisi keuangan lebih ketatData PDB Q2-2024 Jepang, serupa dengan zona Eropa, sehingga meredakan kekhawatiran terkait resesi yang akan melanda negara dengan perekonomian terbesar kedua di Asia. Jepang bertumbuh 0.8% QoQ setelah mengalami kontraksi 0.6% pada Q1-2024. Dalam setahun terakhir, PDB Jepang stagnan karena kenaikan inflasi berdampak penurunan pada pertumbuhan upah riil dan konsumsi selama empat kuartal berturut-turut. Namun, di musim semi tahun ini, kenaikan gaji melebihi inflasi, sehingga konsumsi melonjak sebesar 1.0% QoQ selama Q2-2024.

Kami memperkirakan bahwa pertumbuhan akan terus meningkat di tahun ini juga tahun 2025 mendatang. Namun, kami berpandangan Neutral pada ekuitas Jepang saat ini karena Bank of Japan (BOJ) telah menaikkan suku bunga di bulan Maret dan Juli menjadi 0.25% untuk menekan inflasi dan diperkirakan kembali menaikkan suku bunga menjadi 0.50% dalam sisa tahun ini. Kenaikan suku bunga mendorong penguatan Yen dari posisi terendah selama empat dekade di 161 terhadap Dolar AS. Namun, pengetatan moneter dan penguatan mata uang menjadi hambatan bagi saham domestik.

EQUITIES

Masih dengan skenario soft-landing

Kami masih merekomendasikan skenario soft-landing untuk perekonomian AS. Pemangkasan suku bunga oleh The Fed akan mendorong kinerja aset risiko seperti saham. – Eli Lee

Kehawatiran atas resesi masih menjadi pemicu volatilitas pasar saham. Walaupun probabilitas terjadinya resesi belum sepenuhnya bisa dihilangkan, ekspektasi kami adalah skenario soft-landing di AS dan penurunan suku bunga dapat mendorong kinerja aset risiko.

Di sisi lain, fokus para pelaku pasar juga tertuju pada perkembangan politik AS seiring dengan semakin mendekatnya pemilu di bulan November. Hasil dari pemilu tentu berpengaruh besar terhadap hubungan geopolitik dan juga prospek sektoral dunia usaha.

Kami masih mempertahankan posisi Overweight terhadap kelas aset saham, terutama pada ekuitas Asia ex-Jepang seperti India, Hong Kong, China, Indonesia, Korea Selatan, dan Singapura.

Kami cenderung menyukai strategi barbel dari segi pemilihan sektor. Sektor teknologi masih ditopang oleh pertumbuhan yang kuat, dimana terdapat peluang dari beberapa nama besar seperti Amazon, Microsoft, dan Alphabet. Selain itu, sektor kesehatan dan bahan pokok konsumen juga akan diuntungkan seiring dengan reli penguatan aset risiko secara menyeluruh di berbagai sektor.

AS – Mempersiapkan pemulihan

Pasar saham AS mengalami volatilitas yang cukup tinggi selama bulan Agustus. Sejumlah investor yang keluar dari transaksi “Yen Carry Trade” dan juga kekhawatiran atas potensi terjadinya resesi sempat memicu kenaikan yang signifikan pada indeks volatilitas VIX. Akan tetapi, seiring dengan rilisan data yang dinilai masih cukup baik, indeks S&P500 berhasil menguat kembali.

Kami tidak mempercayai bahwa pasar saham saat ini berada dalam teritori “bubble”. Valuasi beberapa perusahaan teknologi besar masih relatif normal, sementara permintaan atas produk-produk berbasis teknologi yang masih tinggi dapat mendukung sektor tersebut.

Zona Eropa – Mempertimbangkan latar belakang struktural jangka pendek

Investasi pada pasar ekuitas Eropa seringkali merupakan aksi siklikal, dapat dipertimbangkan disaat laporan Purchasing Managers Indices (PMI) – terutama sektor manufaktur mulai mencatatkan kinerja yang baik. Namun, pemulihan siklikal yang diharapkan sejauh ini belum terealisasi seiring dengan ekonomi terbesar Eropa, Jerman yang masih berada di zona kontraksi. Data PMI Zona Eropa memang mencatatkan kenaikan di bulan Agustus, terutama didukung oleh sektor jasa Prancis ditengah Olimpiade Paris, namun dikhawatirkan masih belum cukup stabil.

PMI Inggris setidaknya dapat lebih bertahan dan relatif lebih kuat. Hal ini ditambah dengan valuasi ekuitas Inggris yang rendah, sehingga meningkatkan daya tarik untuk berinvestasi di Inggris.

Latar belakang struktural Eropa, dimana populasi yang menua, masalah utang pemerintah, likuiditas yang lebih rendah di pasar sahamnya dibandingkan pasar AS, dan persaingan yang ketat untuk investasi karena Undang-Undang CHIPS (Creating Helpful Incentives to Produce Semiconductors) dan IRA (Inflation Reduction Act) – adalah beberapa faktor yang membebani investor. Meskipun demikian, perusahaan-perusahaan Eropa dengan mitra dagang global setidaknya terbantu dengan 50% pendapatan yang berasal dari penjualan luar negeri, sehingga menjadi lebih efisien dalam penggunaan modal, yang berdampak pada tendensi buyback dan pemberian dividen. Terhadap latar belakang ini, kami mempertahankan posisi Neutral pada ekuitas Eropa.

Jepang – Fokus pada sektor defensif dan sektor lainnya yang bergantung pada permintaan domestik

Indeks MSCI Jepang hampir berhasil menghapus penurunan yang terjadi di bulan Agustus seiring dengan fundamental yang membaik dan proyeksi pertumbuhan laba yang positif untuk para korporasi. Dunia usaha di Q2-2024 lalu menunjukkan pertumbuhan yang solid, dimana sekitar dua-per-tiga dari total perusahaan-perusahaan berhasil mencatatkan kinerja di atas estimasi.

Asia ex-Jepang – Meredanya kekhawatiran resesi ditengah rilisan data yang bervariatif

Indeks MSCI Asia ex-Jepang mengawali perdagangan di bulan Agustus dengan pelemahan yang dalam, sempat turun 6.2% sebelum akhirnya berhasil menguat secara signifikan, berhasil ditutup lebih tinggi. Kami percaya meredanya kekhawatiran investor atas potensi terjadinya resesi di AS berhasil menjadi katalis utama ditengah pelemahan Dolar AS. Sekitar 83% perusahaan dalam indeks MSCI Asia eks-Jepang (berdasarkan kapitalisasi pasar) telah melaporkan hasil kinerja Q2-2024. Dimana lebih banyak yang melaporkan kinerja positif dengan pertumbuhan laba bersih mencapai 29% secara tahunan (YoY).

Kami masih mempertahankan posisi Overweight pada Asia ex-Jepang, sembari terus mencermati sisa musim laporan laba Q2-2024, yang sebagian besar merupakan perusahaan-perusahaan dari China dan Malaysia yang belum menyampaikan laporan.

China/HK – Rasio “Risk-Reward” masih cenderung positif, namun harus lebih berhati-hati

Indeks Hang Seng berhasil mencatatkan kinerja yang lebih baik dibandingkan MSCI China dan CSI300 di bulan Agustus. Didalam indeks MSCI China, sektor energi dan keuangan memimpin penguatan. Komentar dovish oleh Ketua Fed Jerome Powell pada simposium Jackson Hole bulan lalu dan imbal hasil obligasi pemerintah China tenor 10 tahun yang saat ini berada di sekitar level terendahnya dalam sejarah (di kisaran 2.16%) seharusnya dapat membuat aset risiko menjadi lebih menarik.

Global Sectors – Antisipasi suku bunga yang lebih rendah

Selama bulan lalu, sektor Barang Konsumsi Pokok, Kesehatan, Properti, dan Utilitas telah mencatatkan kinerja yang lebih baik dibandingkan sektor lainnya. Merupakan hal yang wajar terjadi menjelang pemangkasan suku bunga Fed dimana investor mencari sektor yang relative defensif. Bidang bioteknologi yang termasuk didalam sektor Kesehatan, biasanya berfokus pada pengembangan konsep dan produk yang kompleks, membutuhkan arus kas yang cukup besar untuk masa waktu yang lama, bidang ini diharapkan mengalami pemulihan dalam valuasi seiring dengan penurunan suku bunga.

BONDS

Neutral terhadap asset pendapatan tetap

Secara keseluruhan kami berpandangan neutral pada instrumen pendapatan tetap. Walaupun fundamental makroekonomi saat ini masih positif, kami tetap mewaspadai potensi volatilitas dalam beberapa pekan mendatang. Seiring dengan perkiraan tingkat suku bunga yang lebih rendah menjelang akhir tahun, kami melihat tingkat imbal hasil saat ini cukup menarik. – Vasu Menon

Secara keseluruhan kami berpandangan neutral pada instrumen pendapatan tetap. Walaupun fundamental makroekonomi saat ini masih positif, kami tetap mewaspadai potensi volatilitas dalam beberapa pekan mendatang. Seiring dengan perkiraan tingkat suku bunga yang lebih rendah menjelang akhir tahun, kami melihat tingkat imbal hasil saat ini cukup menarik, dan mungkin level saat ini tidak akan bertahan terlalu lama. Pandangan kami Neutral pada obligasi Investment Grade negara maju (DM) dan DM High Yield (HY). Di kategori negara berkembang (EM), kami lebih menyukai obligasi HY dibandingkan IG. Kami tetap Neutral terhadap durasi, dengan preferensi terhadap obligasi bertenor pendek hingga menengah.

Suku bunga dan obligasi pemerintah AS

Pada saat penulisan artikel, indeks futures telah memperhitungkan penurunan suku bunga sekitar 100 bps pada tiga pertemuan mendatang di sisa tahun ini (September, November dan Desember). Antisipasi investor terhadap pemangkasan suku bunga kemungkinan besar akan berdampak lebih besar pada obligasi tenor pendek. Kami percaya ruang untuk kenaikan lebih lanjut pada imbal hasil UST 10 tahun akan terbatas, mengingat seberapa besar kinerja yang tecermin pada harga pasar saat ini. Dengan kondisi yang ada, kami tetap Neutral dalam hal durasi.

Negara maju

Setelah awal yang buruk di bulan Agustus seiring kekhawatiran terjadinya hard landing di AS, selisih imbal hasil (spread) aset pendapatan tetap pada DM IG saat ini berada pada level yang cukup tipis, karena pasar obligasi telah memperhitungkan kondisi soft-landing. Selain itu, pasar primer kembali pulih dengan cepat setelah terjadi disrupsi di awal bulan Agustus. Kesepakatan kembali terjadi dimana korporasi mengambil keuntungan dari imbal hasil yang lebih rendah untuk menarik investor kembali ke pasar primer.Mengingat kenaikan yang terjadi pada imbal hasil US Treasury (UST), kini investor pendapatan tetap menghadapi imbal hasil yang lebih rendah, dengan rata-rata imbal hasil terburuk (yields-to-worst – YTW) untuk DM IG pada titik terendah sejak awal tahun ini (YTD) sebesar 5.07%.Jika The Fed dapat melewati siklus inflasi ini dan skenario soft-landing berhasil diterapkan, maka kondisi pasar obligasi akan cenderung bullish. Jika terjadi resesi, pelebaran selisih imbal hasil akan mengimbangi penurunan suku bunga, sehingga berpotensi menghasilkan tingkat keuntungan yang tidak terlalu besar. Dengan demikian, kami menegaskan kembali preferensi yang lebih defensif dengan tetap berada pada kurva kualitas. Kami memandang obligasi jangka menengah sebagai mitigasi risiko dalam menghadapi risiko durasi akibat volatilitas suku bunga, juga memungkinkan investor untuk memperoleh keuntungan.

Negara berkembang

Kami mempertahankan pandangan Neutral secara keseluruhan terhadap obligasi EM, dengan preferensi pada kategori HY dibandingkan IG. Walaupun pergerakan selisih imbal hasil sepertinya tidak akan menipis lebih jauh dari level saat ini, prospek imbal hasil yang atraktif masih mendorong kami untuk Overweight terhadap obligasi EM HY.

Asia

Pasar obligasi Asia telah menutup pelebaran spread yang terjadi pada awal bulan Agustus. Pasar obligasi Asia membukukan kinerja total yang solid sebesar 1.7% MTD, didukung oleh imbal hasil UST yang lebih rendah. Obligasi IG sebagai penerima manfaat utama dan lebih unggul dibandingkan HY (kinerja total 1.9% vs 0.4%) dalam sebulan penuh (MTD).Obligasi Indonesia mengungguli negara-negara IG Asia lainnya pada bulan Agustus. Beberapa sentimen yang mendukung penguatan diantaranya, ekspektasi penurunan suku bunga The Fed pada bulan September, potensi pemangkasan suku bunga dalam negeri pada Q4-2024, penguatan Rupiah, serta RAPBN tahun 2025 yang menandakan batas defisit fiskal sebesar 3% masih berlaku. Kami tetap menyukai segmen IG Indonesia namun tetap memantau susunan pejabat di kabinet pemerintahan baru dan perubahan kebijakan subsidi/kompensasi energi.Di China, kami tetap memperhatikan adanya potensi sejumlah langkah pelonggaran yang lebih besar di bulan September/Oktober, terutama dengan berlanjutnya pelemahan penjualan properti. Dampak dari langkah-langkah pelonggaran yang diumumkan masih terbatas karena penerapan yang lambat dan pola konsumsi yang cenderung hati-hati serta perekonomian yang melambat. Kami menggaris-bawahi kembali bahwa langkah-langkah perubahan mungkin memerlukan intervensi langsung dari pemerintah pusat.

FX & COMMODITIES

Harga minyak diperkirakan tetap rendah

Kami memperkirakan harga minyak hanya akan turun sedikit selama setahun ke depan. Sedangkan untuk emas, diperkirakan akan menguat dan kami mempertahankan target harga emas dalam setahun ini di US$2,700 per ons. – Vasu Menon

Minyak

Secara fundamental permintaan/penawaran minyak masih melemah. Minyak mentah Brent turun hampir 14% dari titik tertingginya di bulan April. Pertumbuhan permintaan minyak melambat karena ekonomi China masih lesu, selain itu meningkatnya penetrasi kendaraan listrik di China juga turut membebani pergerakan harga minyak. Pemangkasan produksi minyak pun gagal dalam mendorong kenaikan harga. Ketegangan di Timur Tengah masih tetap tinggi. Baru-baru ini terjadi peningkatan risiko terhadap pasokan minyak produksi Libya. Pemerintah Libya bagian timur mengancam untuk menghentikan ekspor minyak di tengah pertikaiannya dengan pemerintah Tripoli yang diakui secara internasional mengenai kendali bank sentral dan pendapatan minyak.

Kami masih memperkirakan bahwa OPEC akan meningkatkan produksi pada Q4-2024 seperti yang direncanakan. Namun, kami pun tidak begitu terkejut jika OPEC masih ingin melanjutkan pemotongan produksi dengan sukarela jika mengharapkan harga minyak yang lebih tinggi. Permintaan minyak OECD dan India yang kuat, didukung oleh prospek siklus pelonggaran global, akan terus mendukung harga minyak. Perkiraan kami adalah harga minyak berpotensi mengalami sedikit pelemahan pada tahun 2025. Kami terus melihat harga minyak Brent berada di kisaran US$75/barel di tahun depan.

Logam Mulia

Kami memperhatikan bahwa emas memiliki kinerja terbaik dalam keseluruhan portfolio investasi untuk melawan inflasi. Di sisi lain, emas tidak bekerja dengan baik dalam skenario "Goldilocks". Kami mempertahankan target harga emas dalam setahun di US$2.700/ons. Dimana emas merupakan aset jangka panjang yang tidak memiliki imbal hasil, maka suku bunga riil AS yang disesuaikan dengan inflasi, dianggap sebagai biaya (peluang) untuk menyimpan emas, sehingga hal tersebut menjadi pendorong makro bagi pergerakan harga emas. Dari perspektif historis, kita mulai mendekati siklus pemotongan suku bunga Federal Reserve (Fed) di mana logam mulia cenderung berkinerja baik.

Mata Uang

USD melemah selama dua bulan berturut-turut pada bulan Agustus karena pasar semakin meyakini bahwa The Fed akan memulai siklus pemangkasan suku bunga pada bulan September. Pernyataan Powell bahwa "waktunya telah tiba" dalam pidato utamanya di Jackson Hole dengan jelas menunjukkan bahwa siklus pemangkasan suku bunga sudah di depan mata, meskipun ia tidak menyebutkan secara spesifik besaran dan kecepatan pemangkasan. Secara khusus, ia mengatakan bahwa arahnya jelas, sementara waktu dan kecepatan pemangkasan suku bunga akan bergantung pada data yang ada. Fokusnya tertuju untuk mendukung pasar tenaga kerja. Pandangan kami bahwa USD akan mengalami tren penurunan secara bertahap mulai membuahkan hasil karena narasi pengecualian AS memudar dan retorika Fed telah berubah menjadi sangat dovish.

Tingkat penurunan USD bergantung pada (i) seberapa cepat dan dalam pemangkasan suku bunga oleh The Fed; dan (ii) keberlanjutan tema goldilocks.

Meski demikian, risiko pemilu AS merupakan sesuatu yang tidak diketahui. Ada implikasi bagi pasar mata uang karena pergeseran kebijakan fiskal, luar negeri, dan perdagangan dapat terjadi, tergantung pada apakah Trump atau Kamala Harris yang terpilih sebagai presiden berikutnya. Kemenangan Trump dapat meningkatkan ketegangan perdagangan AS-China dan hal itu akan menimbulkan ketidakpastian di pasar, sehingga menyiratkan bahwa volatilitas Dolar AS cenderung meningkat, dan menguat secara bertahap jika terjadi lonjakan ketegangan perdagangan AS-China. Namun, jika Kamala Harris yang memenangkan pemilu, maka beliau akan lebih berfokus pada isu dalam negeri dan membatasi keterlibatan dengan China, seharusnya hal ini menjadi pertanda baik bagi mata uang Asia.

Pemulihan Euro (EUR) pada bulan Agustus sebagian besar dapat dikaitkan dengan pelemahan Dolar AS, sementara selisih imbal hasil obligasi pemerintah UE-AS semakin sempit. Data neraca berjalan yang solid di zona Eropa – juga merupakan salah satu katalis – surplus neraca berjalan bulanan periode Juni 2024 sebesar EUR51 miliar merupakan pencapaian tertinggi sejak Januari 2015 dengan surplus sebesar EUR42.75 miliar

Kenaikan Pound (GBP) disebabkan oleh kombinasi dari pelemahan Dolar AS, BoE yang tidak terlalu dovish, dan rilisan data Inggris yang lebih baik – PMI manufaktur, data sektor jasa, produksi industri, penjualan ritel, data PDB kuartal kedua, dan angka pasar tenaga kerja.

Penguatan Yen Jepang terhadap Dolar AS (USDJPY) berlanjut selama bulan Agustus. Komentar Gubernur Kazuo Ueda baru-baru ini di parlemen memperkuat pandangan bahwa kenaikan suku bunga BOJ tetap menjadi pertimbangan. Ia mengatakan bahwa: (i) tarif saat ini jauh di bawah tarif netral; (ii) BOJ masih berencana menaikkan suku bunga jika perekonomian memenuhi harapan pertumbuhan; (iii) BOJ meyakini penyesuaian kebijakannya sejauh ini sudah tepat.

JPY mungkin menguat dalam skenario risk-off – faktor lain yang mendukung pandangan kami mengenai penurunan lebih lanjut USDJPY. Dalam jangka menengah, kami terus memperkirakan USDJPY akan mengalami tren penurunan secara bertahap karena ekspektasi bahwa langkah selanjutnya adalah The Fed menurunkan suku bunga, sementara BOJ memiliki ruang untuk melakukan normalisasi kebijakan lebih lanjut di tengah tingginya inflasi jasa dan tekanan upah di Jepang.

Politic Returns

Wall Street sepanjang bulan Juli mengalami volatilitas tinggi, sehingga mencatatkan performa yang variatif. Indeks Dow Jones, S&P 500, masing-masing menguat +4.41%, +1.13%, sementara Nasdaq melemah -0.75%. Musim laporan keuangan korporasi Q2-2024 telah mendekati puncaknya di akhir bulan Agustus mendatang. Berdasarkan data Factset pada pekan akhir bulan Juli 2024, sebanyak 75% perusahaan yang tergabung dalam indeks S&P 500 sudah melaporkan kinerja keuangan Q2-2024, dan 78% diantaranya melaporkan laba di atas ekspektasi. Namun demikian, kinerja keuangan beberapa korporasi sektor teknologi, yang mendominasi kapitalisasi pasar di AS memberikan laporan dan outlook ke depan yang lebih lemah dari perkiraan pasar. Kondisi ini mendorong volatilitas pasar keuangan global dan membebani kinerja saham sektor teknologi.

Selain itu, berlanjutnya konflik geopolitik di kawasan Timur Tengah ikut membuat investor menahan diri untuk masuk secara agresif ke dalam aset berisiko. Konflik yang berlanjut dan meluas ke wilayah Timur Tengah lainnya, dapat mendorong kenaikan harga komoditas global, sehingga dikhawatirkan akan menghambat bank sentral untuk melonggarkan kebijakan moneter.

Di satu sisi, indikator perekomian AS dari sisi ketenagakerjaan dan manufaktur dilaporkan mengalami perlambatan pada bulan Juli. Kondisi ini mendorong kekhawatiran investor akan risiko resesi yang dapat melanda ekonomi AS, sehingga rencana bank sentral Fed yang akan melakukan pemangkasan suku bunga pada bulan September mendatang dinilai terlambat untuk dilakukan.

Di Asia, perekonomian China terlihat masih belum stabil, terlihat dari indikator sektor manufaktur NBS bulan Juni yang masih berada pada zona kontraksi 49.4, sedikit lebih rendah dibandingkan periode sebelumnya di level 49.5. Belum pulihnya sektor manufaktur China berkorelasi dengan rendahnya permintaan pasar. Namun demikian, pemerintah China terus berkomitmen untuk mendukung perekonomian dengan memberikan sejumlah stimulus ekonomi, diantaranya dengan kembali memangkas tingkat suku bunga dasar kredit atau Loan Prime Rate sebanyak 10 bps, baik untuk tenor satu dan lima tahun menjadi 3.35% dan 3.85%.

Beralih ke domestik, pertumbuhan ekonomi RI untuk Q2-2024 dilaporkan sebesar 5.05%, lebih tinggi dibandingkan konsensus sebesar 5%. Kontribusi pertumbuhan ekonomi datang dari tingginya konsumsi masyarakat, terutama disaat libur hari raya. Selain itu, tingkat inflasi domestik pada bulan Juli berada di 2.13% y-o-y, lebih rendah jika dibandingkan periode sebelumnya di 2.51%, di tengah tekanan harga komoditas global yang menurun. Dari kebijakan moneter, Bank Indonesia memutuskan mempertahankan tingkat suku bunga acuan di level 6.25%. BI menilai keputusan tersebut memadai untuk menjaga stabilitas nilai tukar Rupiah, serta mengarahkan inflasi inti dan inflasi indeks harga konsumen (IHK) terkendali dalam kisaran 2.5±1% hingga akhir tahun 2024.

Equity

Bursa saham IHSG mencatatkan kenaikan sebesar 2.72% sepanjang bulan Juli. saham di sektor Industri dan Transportasi memimpin penguatan masing-masing sebesar 12.05% dan 11.40%. Penguatan pasar saham di bulan Juli didorong salah satunya dari aliran dana asing yang sepanjang bulan Juli telah masuk lebih dari Rp 2 triliun. Ekspektasi pemangkasan suku bunga Fed yang lebih agresif turut mendorong ekspektasi investor bahwa Bank Indonesia dapat segera memangkas suku bunga acuan.

Tingkat suku bunga yang lebih rendah akan mengurangi beban pinjaman korporasi dan mendorong pendapatan perusahaan. Tak hanya itu, likuiditas pun berpotensi meningkat. Beberapa sektor yang dapat diuntungkan dengan pemangkasan suku bunga, adalah sektor seperti perbankan, konsumsi, teknologi informasi, hingga ke properti.

Bond

Pergerakan pasar obligasi di bulan Juli cenderung menguat, terlihat dari pergerakan imbal hasil pemerintah RI tenor 10 tahun yang mengalami penurunan sebanyak -2.40% menjadi 6.90%, yang artinya terjadi kenaikan dari sisi harga. Penurunan imbal hasil ini mengikuti imbal hasil acuan US Treasury 10 tahun, yang turun dari 4.46% ke level 4.02% di akhir bulan Juli. Hal ini turut mendorong pembelian obligasi oleh investor asing yang mencari imbal hasil lebih tinggi terutama di negara emerging. Investor asing tercatat melakukan pembelian bersih sekitar Rp 4.8 triliun sepanjang bulan Juli. Kenaikan minat investor turut didukung oleh nada kebijakan bank sentral Fed yang mengindikasikan akhir fase kenaikan suku bunga dengan melihat tren penurunan inflasi.

Penurunan imbal hasil yang relatif cukup cepat dalam jangka waktu singkat, berpotensi memicu aksi profit taking oleh investor. Namun, dalam jangka waktu menengah, seiring meredanya laju inflasi maka selisih antara inflasi dan imbal hasil obligasi pemerintah RI atau real yield, akan tetap berada di level yang cukup menarik dibandingkan rata-rata obligasi investment grade lainnya. Hal ini akan menjadi daya tarik bagi investor asing untuk tetap masuk ke pasar obligasi domestik.

Currency

Mata uang Rupiah bergerak menguat sepanjang bulan Juli, terlihat dari pergerakannya yang bergerak turun sebanyak -0.70% sepanjang bulan Juli ke kisaran Rp 16,260 per Dolar AS (USD). Keputusan Bank sentral Fed yang kembali menahan kebijakan suku bunga pada pertemuan awal bulan Agustus sesuai dengan ekspektasi pasar, namun pimpinan Fed, Jerome Powell memberikan pidato yang bernada dovish paska pertemuan tersebut, dengan mensinyalkan pemangkasan suku bunga pada pertemuan bulan September mendatang.

Selain itu, neraca perdagangan kembali mengalami surplus pada bulan Juni 2024 sebesar USD 2.39 miliyar, serta naiknya cadangan devisa Indonesia di level USD 145.4 miliyar pada bulan Juli, atau setara dengan pembiayaan 6.5 bulan impor atau 6.3 bulan impor dan pembayaran utang luar negeri pemerintah, serta berada di atas standar kecukupan internasional sekitar 3 bulan impor. Kenaikan cadangan devisa berasal dari penerbitan sukuk global pemerintah dan kenaikan penerimaan pajak barang/ jasa.

Juky Mariska, Wealth Management Head, OCBC Indonesia

GLOBAL OUTLOOK

Pasar keuangan diperkirakan lebih berfluktuasi jelang pemilihan umum November mendatang. – Eli Lee

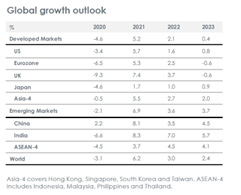

Sepanjang tahun ini, outlook ekonomi lebih berpihak ke sisi investor. Di AS, Fed diperkirakan akan memangkas suku bunga mulai September sejalan dengan proyeksi ekonomi yang diperkirakan mengalami soft landing. ECB memulai pemangkasan suku bunga sejak bulan Juni seiring pemulihan Zona Eropa dari resesi tahun lalu. Di Inggris, inflasi melandai dan pertumbuhan yang lebih stabil mendorong BOE untuk memangkas suku bunga di bulan Agustus ini. PBOC menurunkan suku bunga pertama kalinya setelah hampir satu tahun terakhir untuk mendorong pertumbuhan, dan BOJ menaikkan suku bunga secara perlahan untuk menjaga inflasi di sekitar target 2%.

Hingga sisa tahun ini, sepertinya akan lebih menantang dengan adanya peningkatan risiko politik. Pemilu Prancis yang digelar secara mendadak di bulan Juli, menghasilkan parlemen yang tidak memiliki mayoritas suara untuk mereformasi dan menurunkan defisit anggaran negara yang besar. Para investor juga dikejutkan oleh para pemilih di India, Meksiko, dan Afrika Selatan. Hanya pemilu Inggris yang memberikan sentimen baik bagi pasar keuangan, dengan mayoritas suara dari kemenangan pemerintahan baru maka kestabilan politik yang sangat dibutuhkan dapat tercapai.

Fokus saat ini adalah pada pemilu AS. Volatilitas kembali meningkat, setelah Presiden Biden yang memutuskan mundur dari pencalonan kembali dan mantan Presiden Trump selamat dari upaya pembunuhan. Jika Partai Demokrat di bawah Wakil Presiden Harris memenangkan pemilu, maka penurunan inflasi saat ini memungkinkan Fed untuk kembali memangkas suku bunga pada tahun 2025. Namun, jika Partai Republik menang, maka inflasi diperkirakan kembali meningkat akibat naiknya tarif dagang, imigrasi juga lebih diperketat, dan defisit anggaran diperkirakan lebih besar.

Risiko inflasi AS tetap "tinggi untuk waktu yang lebih lama", sehingga mendorong kami untuk meningkatkan perkiraan imbal hasil US Treasury (UST) tenor 10 tahun dari 3.75% menjadi 4.25%. Dengan demikian, kami merekomendasikan investor untuk tetap Neutral pada pendapatan tetap sambil mempertahankan posisi Overweight moderat pada saham.

AS – Risiko pemilu meningkatkan volatilitas di pasar keuangan

Perlambatan pada ekonomi AS mendorong Fed untuk mulai memangkas suku bunga dari level tertingginya sejak 23 tahun di 5.25-5.50%. Meskipun pertumbuhan ekonomi Q2-2024 mencatatkan peningkatan aktivitas ekonomi AS sebesar 2.8% secara tahunan, namun data ketenagakerjaan bulan Juli memperlihatkan lonjakan pada tingkat pengangguran menjadi 4.3%, yang merupakan level tertinggi sejak akhir 2021, dan Consumer Price Index (CPI) bulan Juli menunjukkan inflasi inti turun menjadi 3.2%, yang merupakan level terendah dalam tiga tahun terakhir.

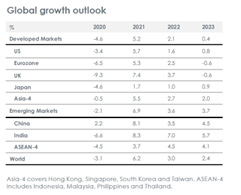

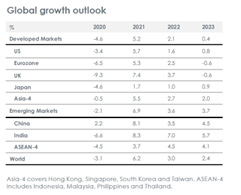

Kami memproyeksikan Fed akan mulai menurunkan suku bunga acuannya pada bulan September sebesar 25 basis poin (bps) seiring inflasi berjalan mendekati target 2% dan kembali melakukan penurunan lebih lanjut sebesar 25 bps pada bulan Desember. Dengan demikian, perlambatan ekonomi AS mengarah pada penurunan suku bunga, imbal hasil obligasi, dan Dolar AS sampai dengan penghujung tahun 2024.

Namun, saat ini investor semakin berfokus pada pemilu AS di bulan November. Volatilitas kembali meningkat setelah Presiden Biden memutuskan untuk mundur dan tidak mencalonkan diri lagi dan mantan Presiden Trump selamat dari upaya pembunuhan.

Mundurnya Biden meningkatkan persaingan yang lebih ketat sekaligus menurunkan peluang bagi Partai Republik untuk menguasai Gedung Putih dan Kongres, sehingga dapat memerintah tanpa oposisi. Apabila partai Demokrat di bawah Wakil Presiden Harris menang, maka inflasi diperkirakan akan kembali turun di tahun 2025 karena ia diperkirakan mengambil kebijakan serupa dengan kepemimpinan Biden. Namun, jika Trump kembali menang, maka inflasi diperkirakan kembali naik, yang berpeluang menahan Fed untuk menurunkan suku bunga lebih lanjut tahun depan.

Oleh karena itu, pemilu AS diperkirakan dapat meningkatkan volatilitas di tahun ini, sementara outlook tahun depan menjadi lebih tidak menentu.

Menurut kami, pada masa jabatan Trump berikutnya dapat berpotensi mendorong kenaikan inflasi, imbal hasil US Treasury (UST) dan USD yang lebih kuat, disebabkan pemotongan pajak akan memperlebar defisit anggaran, kenaikan tarif akan membuat impor menjadi lebih mahal, pembatasan imigrasi dan tekanan politik terhadap Fed akan meningkatkan ekspektasi inflasi. Sebaliknya, jika Harris menang, maka defisit anggaran yang lebih rendah berdampak pada penurunan inflasi, sehingga memberikan kesempatan bagi Fed untuk kembali menurunkan suku bunga di tahun 2025.

Oleh karena itu, kami mempertahankan pandangan kami dengan dua kali pemangkasan suku bunga Fed masing-masing sebesar 25 bps tahun ini, namun hanya melihat satu kali penurunan di semester pertama tahun 2025 mengingat ketidakpastian di bulan November. Kami memperkirakan imbal hasil UST 10 tahun akan tetap tinggi di 4.25% seiring risiko kenaikan inflasi di tahun depan.

China – Secara mengejutkan PBOC memangkas suku bunga untuk mendorong pertumbuhan

Pada bulan Juli, PBOC menurunkan suku bunga 7-day reverse repo rate sebesar 10 bps menjadi 1.70%, penurunan suku bunga pertama sejak Agustus 2023 dan Medium-term Lending Facility (MLF) 1 tahun sebesar 20 bps menjadi 2.30%. Langkah mengejutkan tersebut mengakibatkan Loan Prime Rate 1 tahun dan 5 tahun turun 10 bps menjadi 3.35% dan 3.85%.

PBOC melonggarkan kebijakan yang bertujuan untuk "mendukung ekonomi riil dengan lebih baik". Beberapa langkah seperti melonggarkan kebijakan fiskal dan meringankan pembatasan properti. Sebagai contoh, pemerintah pusat mulai menerbitkan obligasi jangka panjang sebesar CNY 1 triliun untuk membantu investasi dan konsumsi. Rasio minimum untuk uang muka pembelian properti telah dikurangi dan PBOC telah membuat skema pendanaan sebesar CNY 300 miliar agar badan usaha milik negara (SOEs) membeli properti yang tidak terjual.

Kami memperkirakan, masih ada kebijakan pelonggaran mengingat data pertumbuhan ekonomi Q2-2024 China mengalami perlambatan dari 5.3% y-o-y menjadi 4.7% y-o-y. Sisi supply perlahan kembali menguat pasca pandemi, ditopang investasi manufaktur dan ekspor yang solid di tahun ini. Sementara, permintaan masih lemah disebabkan konsumen masih berhati-hati dan pasar properti yang masih rapuh. Inflasi masih bertumbuh, meskipun hanya 0.5% y-o-y di bulan Juli.

Pelonggaran kebijakan PBOC bertujuan untuk memastikan target "pertumbuhan sekitar 5%" tercapai, setelah Rapat Pleno Ketiga, China menjanjikan dukungan tambahan untuk perekonomian. Kami memperkirakan pertumbuhan akan mencapai 5.0% pada tahun 2024 karena pelonggaran lebih lanjut akan membantu aktivitas ekonomi. Oleh karena itu, kami melihat outlook China akan lebih mendukung pasar domestiknya.

Eropa – Zona Eropa melemah, sedangkan Inggris menguat

Setelah mengalami pertumbuhan yang stagnan sepanjang lima kuartal berturut-turut, pada Q1-2024 Zona Eropa memulai tahun ini dengan bertumbuh 0.3% secara kuartalan. Namun, data terbaru menunjukkan aktivitas ekonomi yang diperkirakan kembali melambat. Purchasing Manager Index (PMI) bulan Juli turun ke level terendah sepanjang lima bulan pada 50.9. Survei INSEE Prancis mengenai kepercayaan bisnis turun ke level terendah tiga tahun di 96.2 setelah pemilu di bulan Juli yang menghasilkan parlemen yang tidak seimbang, dan survei IFO Jerman juga turun ke level terendah dalam lima bulan di 87.0. Kami memperkirakan ECB akan merespon dengan melanjutkan pemotongan suku bunga sebesar 25 bps pada bulan September dan Desember setelah memangkas 25 bps dari 4.00% di bulan Juni lalu. Kami memperkirakan Zona Eropa hanya akan mencatat pertumbuhan ekonomi yang lebih moderat sebesar 0.7% tahun ini.

Sebaliknya, kami merevisi naik perkiraan pertumbuhan ekonomi Inggris untuk tahun 2024 dan 2025 menjadi 1.2% dan 1.7% setelah rilis data pertumbuhan yang kuat di bulan Mei. Kami memperkirakan BOE akan melakukan dua kali pemangkasan suku bunga sebesar 25 bps pada suku bunga acuan 5.25% tahun ini termasuk di bulan Agustus, dan mayoritas pemerintahan Partai Buruh yang baru juga akan memacu investasi dengan memberikan stabilitas politik lima tahun ke depan.

Jepang – BOJ menjadi satu-satunya bank sentral yang menaikan suku bunga secara bertahap

Setelah mencatatkan kenaikan yang luar biasa disepanjang tahun lalu, prospek pasar ekuitas Jepang berubah menjadi kurang atraktif seiring dengan penguatan Yen (JPY) di bulan Juli dari level terendahnya dalam empat dekade di angka 161 terhadap USD. Berbeda dengan bank sentral utama dunia lainnya, BOJ menaikkan suku bunga karena lonjakan inflasi setelah tiga dekade yang hilang menyusul guncangan pandemi, kemudian adanya perang di Ukraina dan Gaza.

BOJ menjadi satu-satunya bank sentral yang menaikkan suku bunga secara bertahap, setelah mengakhiri kebijakan suku bunga negatif di bulan Maret dengan menetapkan suku bunga overnight call di 0.00-0.10% dan kembali menaikkan suku bunga menjadi 0.25% pada bulan Juli. Namun, risiko suku bunga yang lebih tinggi dan JPY yang lebih kuat membuat outlook jadi lebih menantang.

EQUITIES

Outlook jangka panjang yang konstruktif

Kami memiliki pandangan Overweight yang cukup moderat pada ekuitas, cenderung Overweight pada pasar ekuitas Asia ex Jepang dan Netral pada ekuitas AS, Eropa, dan Jepang. – Eli Lee

Meskipun terjadi volatilitas dan tekanan pada pasar, kami tetap melihat prospek jangka panjang yang konstruktif untuk ekuitas. Beberapa indikator seperti momentum, positioning, dan tingkat margin, menunjukkan bahwa pasar sudah overvalued untuk jangka pendek, sementara aksi profit taking pada saham-saham Teknologi, serta meningkatnya ketidakpastian terkait pemilihan Presiden AS juga mendorong peningkatan volatilitas. Meskipun demikian, kami menegaskan, bahwa dalam jangka panjang pasar tetap bullish mengingat penurunan suku bunga Federal Reserve (Fed) akan segera terjadi, tren inflasi yang menguntungkan, dan kondisi perlambatan ekonomi (soft-landing) menjadi sinyal positif bagi pendapatan perusahaan.

AS – Rotasi di pasar ekuitas

Terjadi rotasi di pasar ekuitas AS baru-baru ini. Saham teknologi tertentu dengan kapitalisasi besar dan semikonduktor mengalami tekanan, sementara saham-saham yang memiliki valuasi murah dan berkapitalisasi rendah cenderung menguat.

Kami yakin rotasi ini disebabkan oleh beberapa faktor, diantaranya (i) tren disinflasi yang sedang berlangsung dan meningkatnya ekspektasi pasar terhadap pemangkasan suku bunga The Fed, (ii) data makro yang tangguh, dan (iii) meningkatnya kemungkinan kemenangan Trump dalam pemilihan Presiden November. Selain itu, laporan pendapatan beberapa emiten yang tergabung dalam Magnificent Seven juga meleset dari perkiraan dan memberikan panduan ke depan kurang yang meyakinkan.

Meskipun demikian, kami melihat hal ini sebagai koreksi sementara yang sehat dan tidak berdampak negatif untuk prospek jangka panjang Indeks S&P 500. Penguatan lebih lanjut akan didorong oleh penurunan suku bunga The Fed, tren penurunan inflasi, serta prospek pendapatan korporasi yang kuat.

Eropa – Mencermati dampak dari periode kedua kepemimpinan Trump